CHANGE YOUR MONEY HABITS FOR GOOD

WHY YOUR MONEY PROBLEMS

ARE NOT JUST A LACK OF FINANCIAL EDUCATION (OR MONEY)

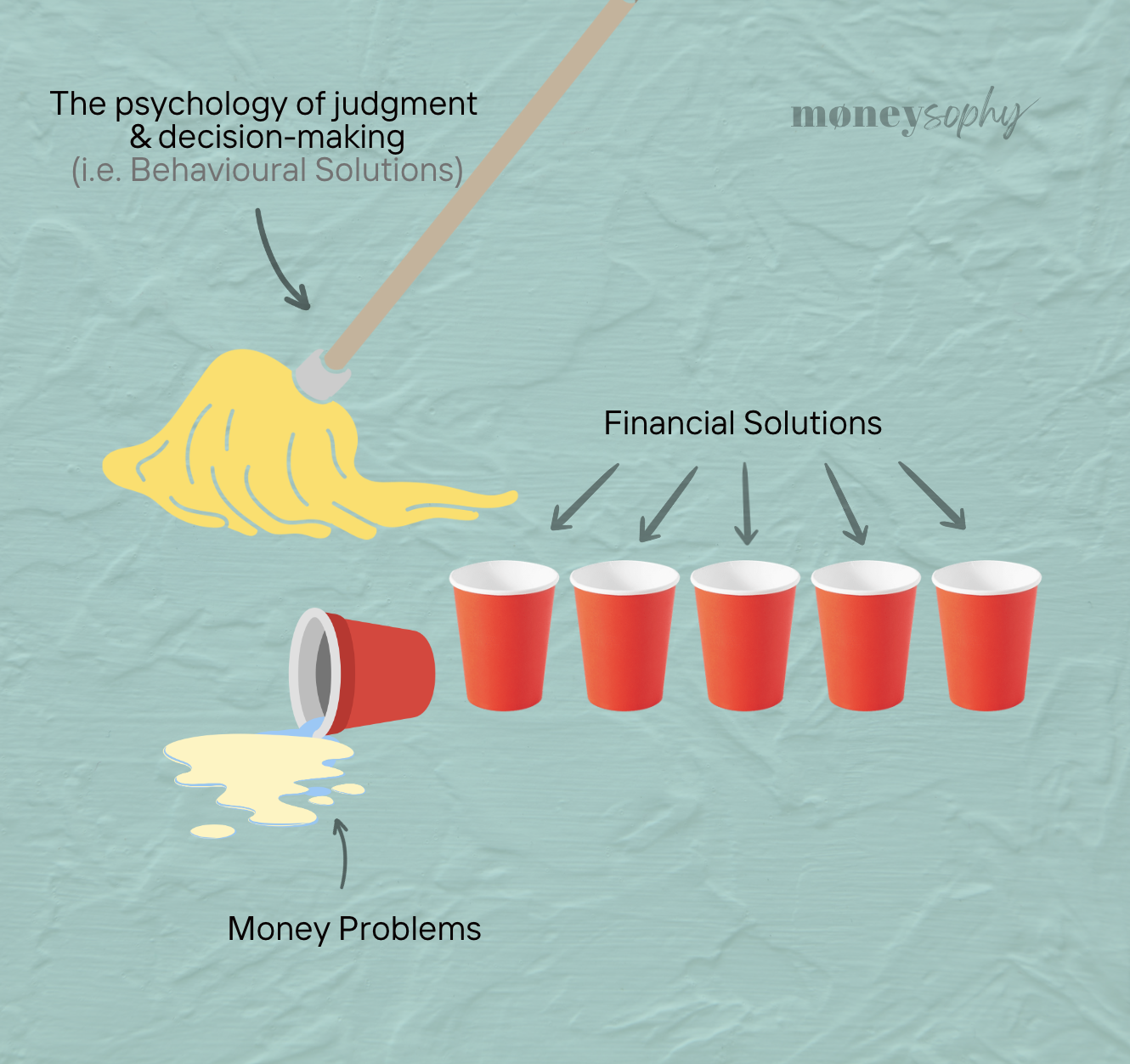

AND How to solve your money problems the right way?

Agenda:

The top 3 common misconceptions about money

How does the brain think about money?

The pros and cons of money beliefs

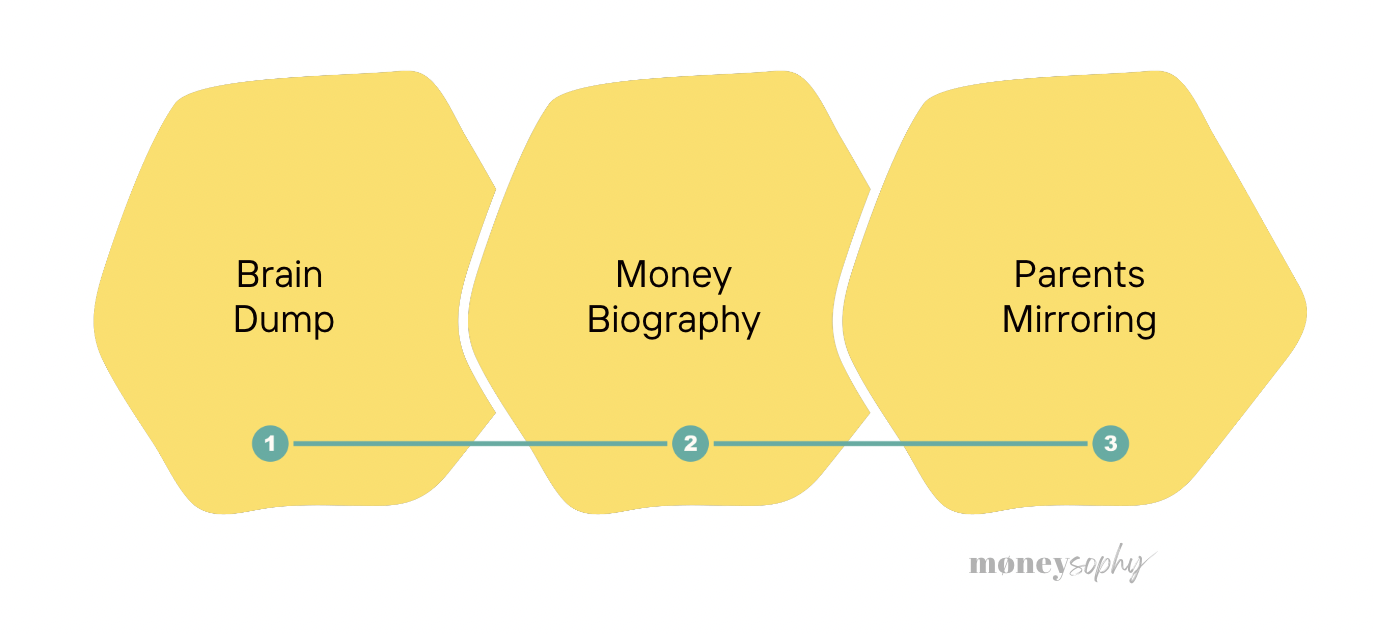

How to identify your own money beliefs?

Brain Dump, Money Biography and Parents Mirroring

How to transform your money beliefs?

Key takeaways of Psychology of Money 101

Frequently Asked Questions

The costs of not knowing your money beliefs

In a previous life, I was a financial advisor, trying to solve financial problems with financial education. It doesn’t work most of the time.

Here I explain why and how to overcome your money problems

The top 3 common misconceptions about money

#1 LACK OF FINANCIAL EDUCATION

A common belief is the absence of financial education in schools or workplaces is the primary reason for people's struggles with money management. While this belief holds some truth, it doesn't provide the full explanation. Typically you tell yourself “when I have time, I will learn…”, “if I know enough, I will invest…” or “when I invest in this, I will feel at peace”, but how often do these promises ring true in reality?

Some of my clients are trapped in the rabbit hole of personal finances, learning the latest investment trends, always chasing for the highest return. That’s not financial planning, that’s a hobby.

Let me clarify once and for all: money isn’t just about maths, money is emotional.

#2 LACK OF MONEY

Another common illusion is that money solves all problems. For instance, when you say “I’ll be happy when I’m rich”, “I will start planning when I have more money”. Money may give you more opportunities in life, but it doesn’t guarantee you will find happiness. We’re trapped in this constant chase for “more”: better career, income growth, car/house/wardrobe upgrades…

I have clients earning six figures and are facing debt issues, and many of them genuinely believe that if they were rich, they wouldn't have found themselves in this situation…

As a result: more money will make you crave more, and spend more, not happier.

#3 MONEY PROBLEMS SOLVE THEMSELVES

Last but not least, another common belief is that you can just procrastinate, and somehow your money problems will magically vanish as you get older. I often hear “I will start thinking about money later or when I earn x”.

Unfortunately, I have clients in their 50s and 60s who come to me, still grappling with financial anxiety. My conclusion: it’s more challenging to break bad money habits formed for over 40+ years than 10 years.

So no, your personal finances will not miraculously resolve themselves.

And more than that, no one will be as invested in your financial well-being as you are.

How does the brain think about money?

So why do we say that money is emotional?

Let’s dive into neuroscience 101 to explain how our brilliant brains think.

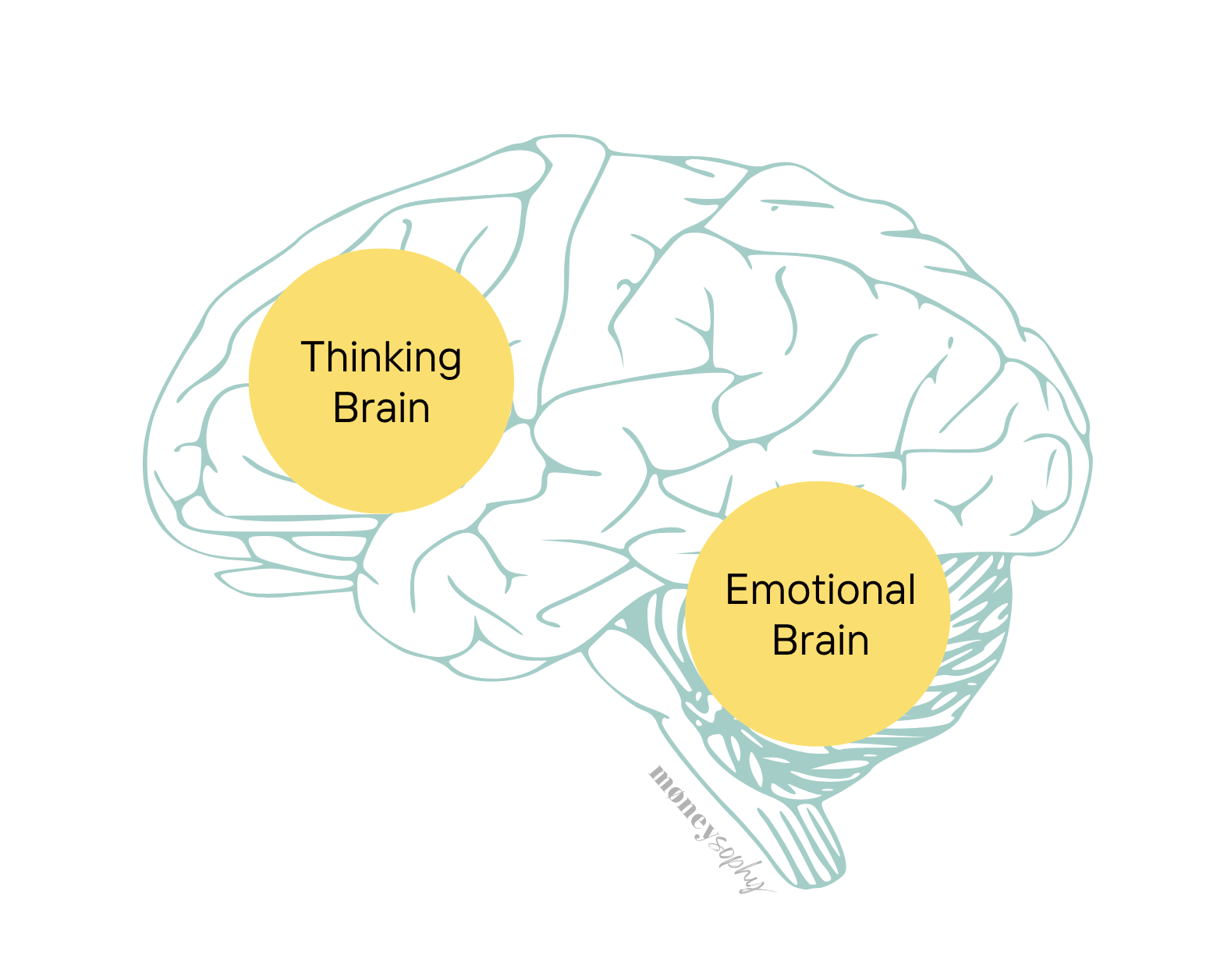

Simply put, we have two brains that dictate our behaviours:

The Thinking Brain (Prefrontal Cortex): This is the part of the brain we primarily use when engaged in cognitive tasks. It involves problem-solving, logical reasoning, and operates best when we are in a calm state. Activation of this brain region takes longer but leads to more thoughtful responses.

The Emotional Brain (Limbic System): This brain region generates primal impulses and emotional responses. It is responsible for the fight-flight-freeze response and is often triggered by external stimuli. It reacts quickly, sometimes leading us to engage in actions that we may not fully understand or even regret later.

In many situations, the activation of our emotional brain is not necessarily related to our level of intelligence. Even the smartest individuals can be triggered emotionally and engage in regretful behaviours.

One of the challenges we face is being unaware of our triggers and how to manage the emotions that hijack our thinking brain.

This is particularly common in money-related situations, leading to issues like overspending, financial anxiety, or engaging in speculative investments.

Your emotional brain is also where your past emotions are stored, this also explains why your financial behaviours are the consequences of your experiences.

The pros and the cons of money beliefs

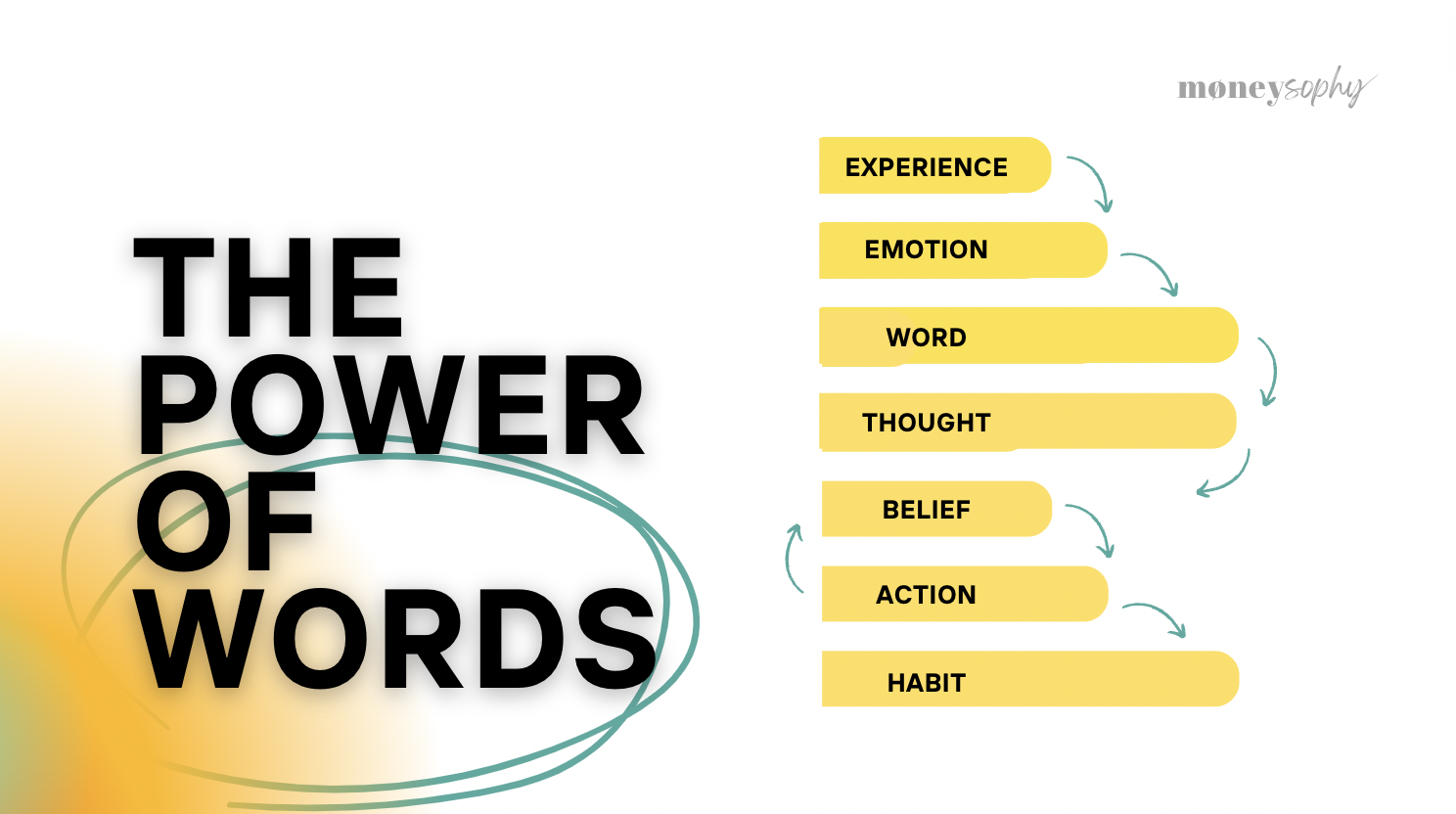

Let's start by understanding what a money belief is.

Money beliefs are like sneaky little creatures. They may be invisible, but their impact can be louder than a rock concert. These beliefs have the remarkable ability to dictate our actions, both consciously and subconsciously. They hold immense power over us.

The pros

There are some awesome money beliefs you’ve cultivated that have made a real impact on your life. They've been the secret sauce behind your hard work and success. These beliefs have fuelled your hustle game, pushing you to put in the effort every single day.

These same money beliefs have also given you the power to shape your own destiny subconsciously. You've been able to make smart choices when it comes to your studies and career. You've taken control and pursued your dreams with determination.

The cons

There are some tricky money beliefs that have played a not-so-great role in your life.

They may lead you to reject money, obsess over it, or create issues in your relationships.

These beliefs often result in unconscious overspending, suffering from chronic not-good enough, a desire for always wanting more, or even influence our choice of partners.

These same money beliefs can be contradictory and paradoxical. It's like having a split personality when it comes to your money mindset.

Well, you're not alone. Many of us have fallen victim to these tricky beliefs.

It's all about progress, not perfection. You've got the power to reshape your money beliefs and move towards a more balanced and happier future.

How tO identify YOUR OWN money beliefs

Here I’m sharing 3 exercises to label your money beliefs.

Let's kick off with the first exercise: Brain Dump.

Sure, you might be aware of some of the obvious money beliefs, like the ones you often heard your parents repeating. But we're going to dig deeper.

Grab a pen and paper or your favourite note writing app, and without any filter or holding back, jot down the very first things that come to mind when you think about money.

This is your opportunity to empty your mind. No filter, no holding back. Get it all out on paper.

One you finish the list, ask yourself: is there anything else missing?

If you want to take a step further, you can self analyse your money beliefs by assessing whether they are falling into a money disorder category - which is a term coined by Brad Klontz and Ted Klontz in their book Mind over Money.

Money disorders are these persistent, predictable patterns of self-destructive financial behaviours that wreak havoc in our lives. They bring along heaps of stress, anxiety, emotional distress, and seriously mess things up in major areas of our existence.

Here are the three types of common money disorders:

1. Money-Avoidance Disorders

Financial Denial

Financial Rejection

Underspending

Excessive Risk Aversion

2. Money-Worshiping Disorders

Hoarding

Unreasonable Risk Taking

Pathological Gambling

Workaholism

Overspending

Compulsive Buying Disorder

3. Relational Money Disorders

Financial Infidelity

Financial Incest

Financial Enabling

Financial Dependency

The second exercise is named: Money Biography

It's time to take a stroll down memory lane.

This exercise is pure gold in coaching. It helps you understand how your younger self experienced money, but also validation, acceptance, appreciation, love, and belonging. We're talking about connecting the dots between what went down in your childhood and the financial behaviours you hold today.

Find a comfortable spot, close your eyes, and let's embark on a journey through your memories. We'll be scanning your early childhood, focusing on any significant moments related to money. These memories can involve your own experiences or those of your parents, grandparents, or even friends. We want to explore the first money memory that comes to mind.

For instance:

Age 5 - I remember accidentally breaking my father's watch, and he became extremely angry. He slapped me because it was an "expensive gift." I felt an overwhelming sense of shame and somehow devalued compared to that watch. It seemed like the watch held more importance to him than I did. This incident changed our relationship, leaving me feeling angry and deeply saddened.

Age 6 - We lived in a small apartment, and I had to share a room with my brother. I despised it because I didn't have my own space, and my brother would tease me about silly things. I remember feeling annoyed most of the time, but sometimes his actions would upset me to the point of tears. Our parents reassured us that one day, we would move to a bigger house.

Now, let's continue your money biography chronologically, year by year, until the present day. Share the memories, your age at the time, and any associated emotions that arise. You don't need to delve into great detail for each memory. Simply state the memory, your age, and the feelings that come to mind.

Let’s unravel your personal history with money and together create a compelling money biography.

Let's dive into the third and final exercise: Parents Mirroring.

This exercise aims to shed light on the financial behaviours that have been passed down to you by your parents or caregivers.

It's fascinating how we, as kids, are like sponges, absorbing everything we see and hear. Without even realising it, we subconsciously imitate our caregivers or the opposite. Some of the behaviours we exhibit are a result of our unique personalities.

Draw a table with different columns. Each column represents a caregiver that has been omnipresent in your childhood. Perhaps your parents, uncles, aunts, a grandparent etc.

Now, close your eyes, and take a moment to reflect on each of your caregivers’ financial tendencies.

List every adjective or sentence that comes to your mind related to their financial behaviours. It could be something they did or said often.

Are they more of a spender or a saver? Are they a hard worker or a risk-taker? What is their relationship with money? What do they say about rich people or poor people? What is the thing you noticed about them when you were young?

Then once you finish their lists, draw a last column which is yourself, and do the same exercise.

Now you have a clear picture of your money patterns. Highlight the ones that are “inherited” by your caregivers and circle the ones you’ve manifested on your own. By identifying which behaviours originated from whom, you can gain a better understanding of the origins of your own financial behaviours. It's like piecing together the puzzle of your money mindset.

How TO TRANSFORM my money beliefs?

Here you go, you have now identified all your money beliefs, you can move to the next stage which is to let go of money beliefs that no longer serve you.

There are 4 main stages to transform your money beliefs.

Start with one money belief at a time. Don’t try to change everything at once.

Stage 1: Awareness:

If you’ve done the previous exercises, you've already listed a bunch of money beliefs. Take a moment to reflect on how these beliefs have influenced your financial decisions and behaviours up to today. Evaluate whether 1) they truly align with your values and goals 2) they are serving you or holding you back from achieving financial well-being. Highlight the ones susceptibles to have a direct correlation with your negative financial patterns.

Stage 2: Motivation

Why do you want to change them? Identify the shift you desire—ideally an identity shift. Understand why it is important for you to make a change today. Maybe you want to be a role model for your children, a better partner, or simply find peace within yourself and become financially empowered. Perhaps you aspire to achieve your dream of retiring early or having the freedom to do whatever you want. Clarify your reasons for embarking on this journey in the first place.

Stage 3: Implementation

Changing beliefs requires consistency and repetition. Things will not happen overnight. Replace limiting money beliefs with empowering ones. Reframe negative beliefs into positive affirmations that align with your financial aspirations. Consciously make decisions that align with your new empowering beliefs. Over time, these practices will reinforce the new beliefs and reshape your relationship with money.

Stage 4: Appreciation

Embrace the fact that your money beliefs, even the negative ones, have played a role in shaping who you are today. Express gratitude for the lessons they have taught you, and then let go of any beliefs that no longer serve you.

Finally, recognise and celebrate every small step forward you take in changing your money beliefs. Celebrating your progress - instead of the end results only - will reinforce the positive changes and motivate you to continue on your journey towards a healthier money mindset.

With practice, persistence, and a commitment to change, you can create a more empowering and fulfilling relationship with money.

Expectations vs Reality of Money Beliefs Transformation

Key takeaways Psychology of Money 101

Recognise that personal finances is more than just mathematics.

80% is psychology, while only 20% is financial education.

Our childhood experiences directly influence our financial behaviours today.

Beliefs hold immense power, shaping our lives, studies, careers, and relationships.

By changing your words, you can gradually shift your perception and mindset.

Your past has shaped your current money beliefs.

With consistency and persistence, you have the power to transform those beliefs.

Transforming your money beliefs is a journey, learn to appreciate the ups and downs rather than solely focusing on the end results.

Frequently Asked Questions

-

When it comes to changing deeply ingrained money beliefs, it can definitely be a challenge but not impossible.

One strategy you can try is exploring your money triggers. Pay close attention to situations or topics that evoke strong emotions or reactions related to money. These triggers can often provide valuable clues about your deep-seated beliefs and fears. By examining your emotional responses, you can gain insight into the underlying beliefs that drive them.

Another option to consider is working with a Money Coach. Professionnals can offer guidance and support as you navigate the process of transforming your money behaviours. They have specific exercises and techniques that can help you delve deeper into your mindset and uncover the beliefs that may be holding you back. Feel free to book a call here with me to engage the conversation.

Remember, changing your money beliefs is a personal journey, and it may take time and effort. But with self-reflection, exploration of triggers, and the assistance of a professional, you can make progress in transforming your relationship with money.

-

Identifying your money beliefs is a gradual and ongoing process. Be patient with yourself and approach it with curiosity and an open mind. As you delve deeper into your relationship with money, you'll gain clarity and a better understanding of your beliefs.

Here are a couple of perspectives and strategies to consider:

Patience and Self-Compassion: Changing money beliefs takes time and self-compassion. Be patient with yourself and understand that resistance is normal. Embrace the process as an opportunity for personal growth and self-discovery. Remember, you don't have to tackle everything at once. Take your time and work on it gradually over the next few weeks.

Seek Support: Consider seeking support from your partner or a friend. Discussing your money beliefs with others can provide fresh insights and help you challenge any limiting beliefs.

Alternatively, you can also grab a virtual coffee chat with me (click here to book a FREE call) to identify blind spots you may not see on your own.

-

If you find yourself feeling stressed despite having a solid financial plan in place, it's important to recognize that the root of your stress may not lie solely in your financial solutions. In many cases, the underlying issues are emotional or psychological in nature.

Regardless of the level of financial planning you have undertaken, you may still experience stress if there are deeper emotional or psychological challenges at play. Money-related stress often stems from a variety of factors such as fears, limiting beliefs, past experiences, or even relationship dynamics.

In such situations, it's beneficial to seek professional help from a therapist, counsellor, or money coach who can provide guidance tailored to your specific situation. These professionals are trained to help you explore and address the emotional aspects that contribute to your stress. They can assist you in developing coping mechanisms and strategies that go beyond financial planning, helping you build resilience and manage stress more effectively.

-

First and foremost, it's important to remember that differing financial perspectives within a relationship are quite common. We all have unique backgrounds, experiences, and beliefs when it comes to money. The key lies in finding common ground and establishing open and honest communication.

Here are a few steps you can take to navigate this situation:

Open Dialogue: Initiate a calm and respectful conversation with your partner about your financial planning and money beliefs. Create a safe space where both of you can express your thoughts, concerns, and aspirations. Listen actively to understand each other's perspectives without judgment.

You can kickstart the conversation with: What does money mean to you? How was it growing up in your family financially?

Identify Common Goals: Discover shared financial goals that you both can strive towards. It could be saving for a down payment, planning for retirement, or even funding a dream vacation. Finding common ground and aligning your goals can help create a sense of unity and purpose.

You can kickstart the conversation with: How do you see ourselves in 5 and in 10 years? If we win the lottery tomorrow, how would you live your life differently?

WHAT’s NEXT?

If you have applied everything shared in this page, congratulations!

Most people are not aware of their limiting money beliefs. So you are already doing better than 90% of people.

So, what's next? Continue practicing your newly acquired financial habits, enhance your financial planning skills, and consistently work towards building your wealth both in a literal and figurative sense.

Additionally, you might find it beneficial to establish a solid payday routine, aka the 6Ps, to further support your financial journey.

__

Do you find it challenging to identify and/or transform your money beliefs?

Remember, you don't have to navigate this journey alone! I invite you to book a FREE call with me here, where we can discuss your main roadblocks and work together to overcome them.

If you believe that you are experiencing deeper issues, severe addiction, or other mental health concerns, it is important not to isolate yourself. Reach out for professional mental health support in your area.

The costs of not knowing your money beliefs

If you don’t know your money beliefs, you will…

repeat the same mistakes over and over again

wake up one day running out of your savings

worsen your financial anxiety

lack financial confidence

have no financial empowerment