FREE 7-DAY EMAIL COURSE

5 COMMON TRAPS that prevent you to break-free from living paycheck-to-paycheck

+ the ACTION PLAN to overcome them!

Here’s what you’ll learn:

How to identify your money narratives

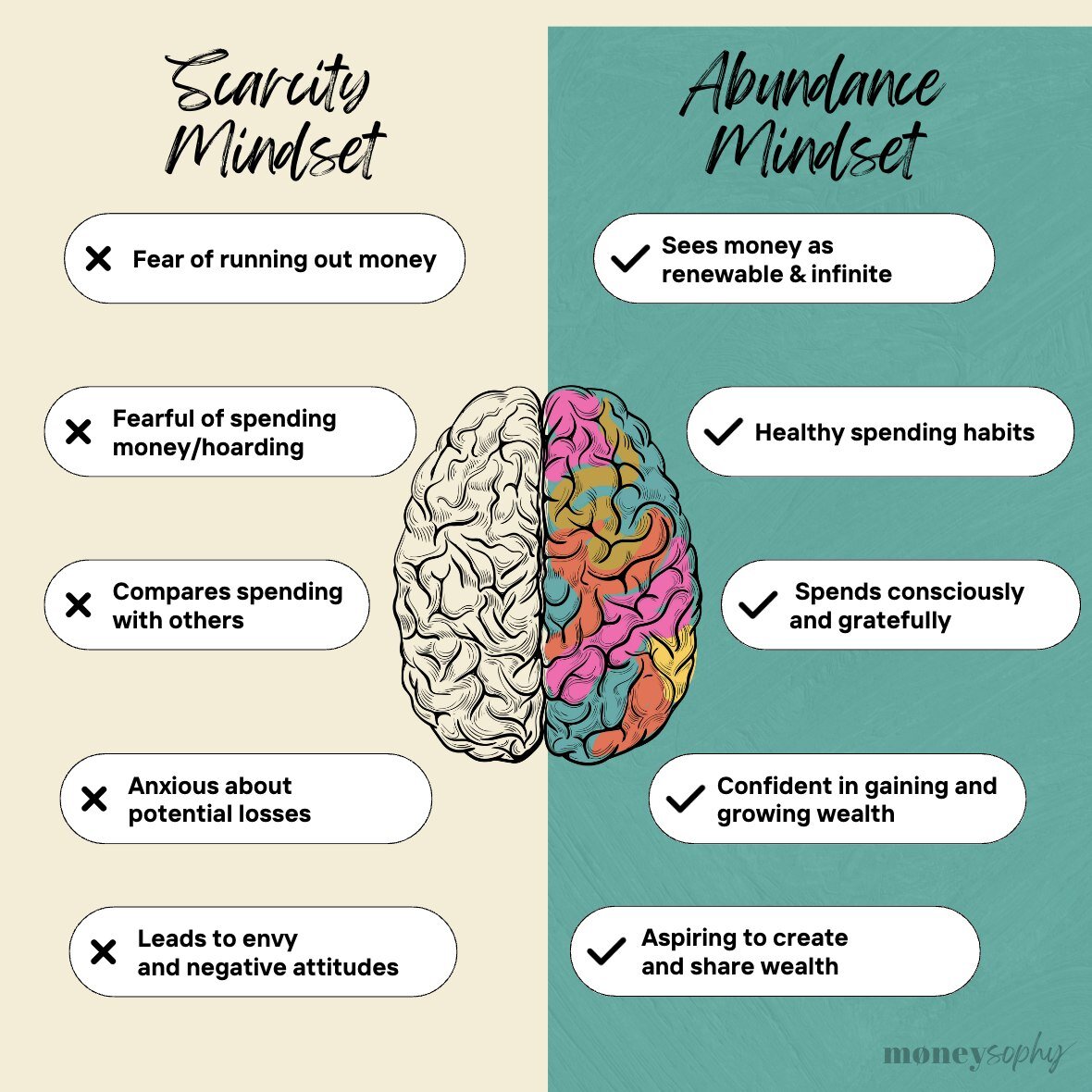

How to adopt the right mindset for your financial health

How to build a payday routine

How to create an automated money management system

sharing the art and science of money

From financial ignorance to financial confidence

modern financial education for mindful individuals

Take control of your life today

WHAT IS MONEYSOPHY?

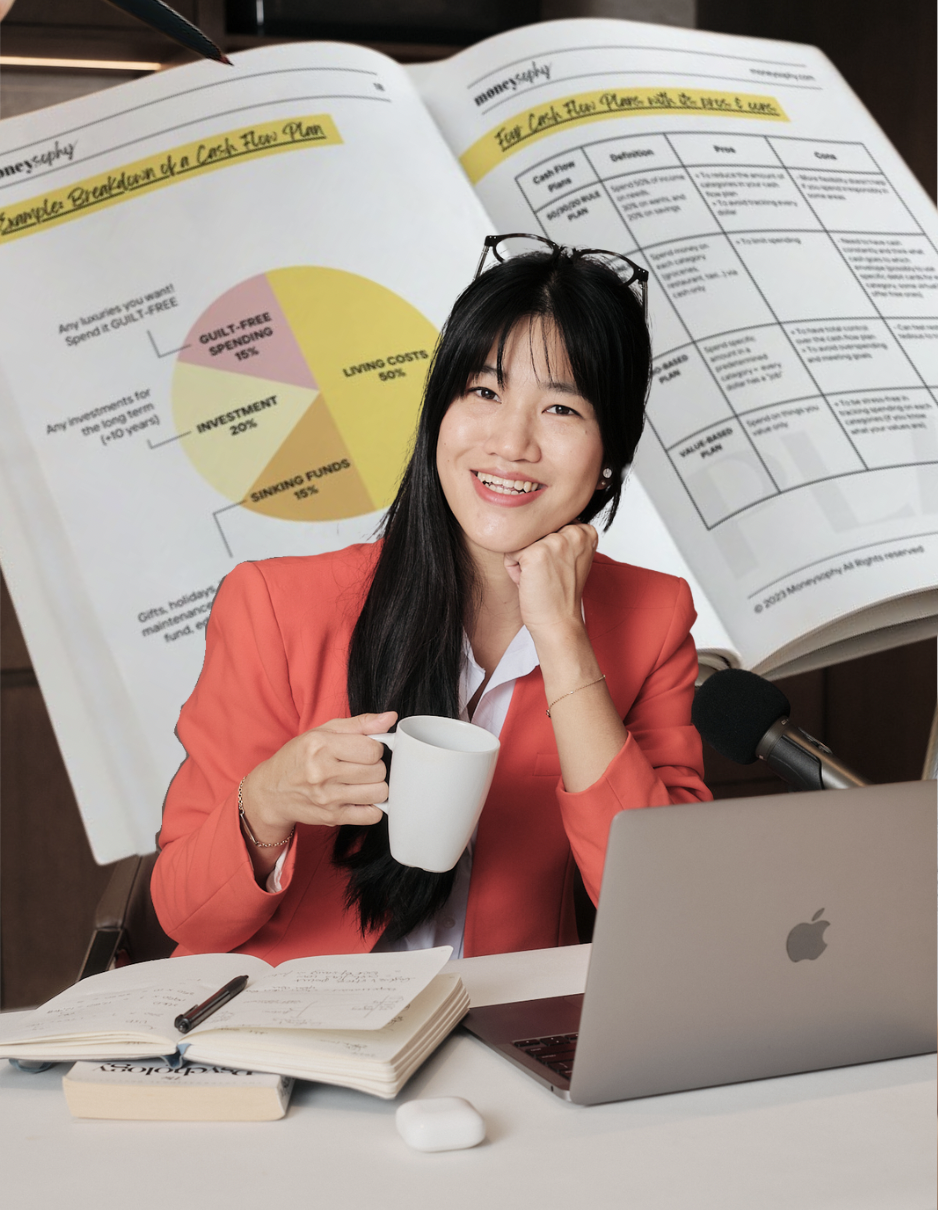

My name is Sophie Hau and I created Moneysophy in 2022, which is a result of a blend of three fields: psychology, coaching and personal finances.

From overspending to financial health

In the last 15 years, I've made a lot of financial faux pas.

I was a spender - I rejected it, craved it, earned it, gambled it and invested it all. It isn’t about how much you have in your bank account, but it’s about the financial confidence. I’ve learned the hard way, don’t waste your time and money.

From financial confidence to financial empowerment

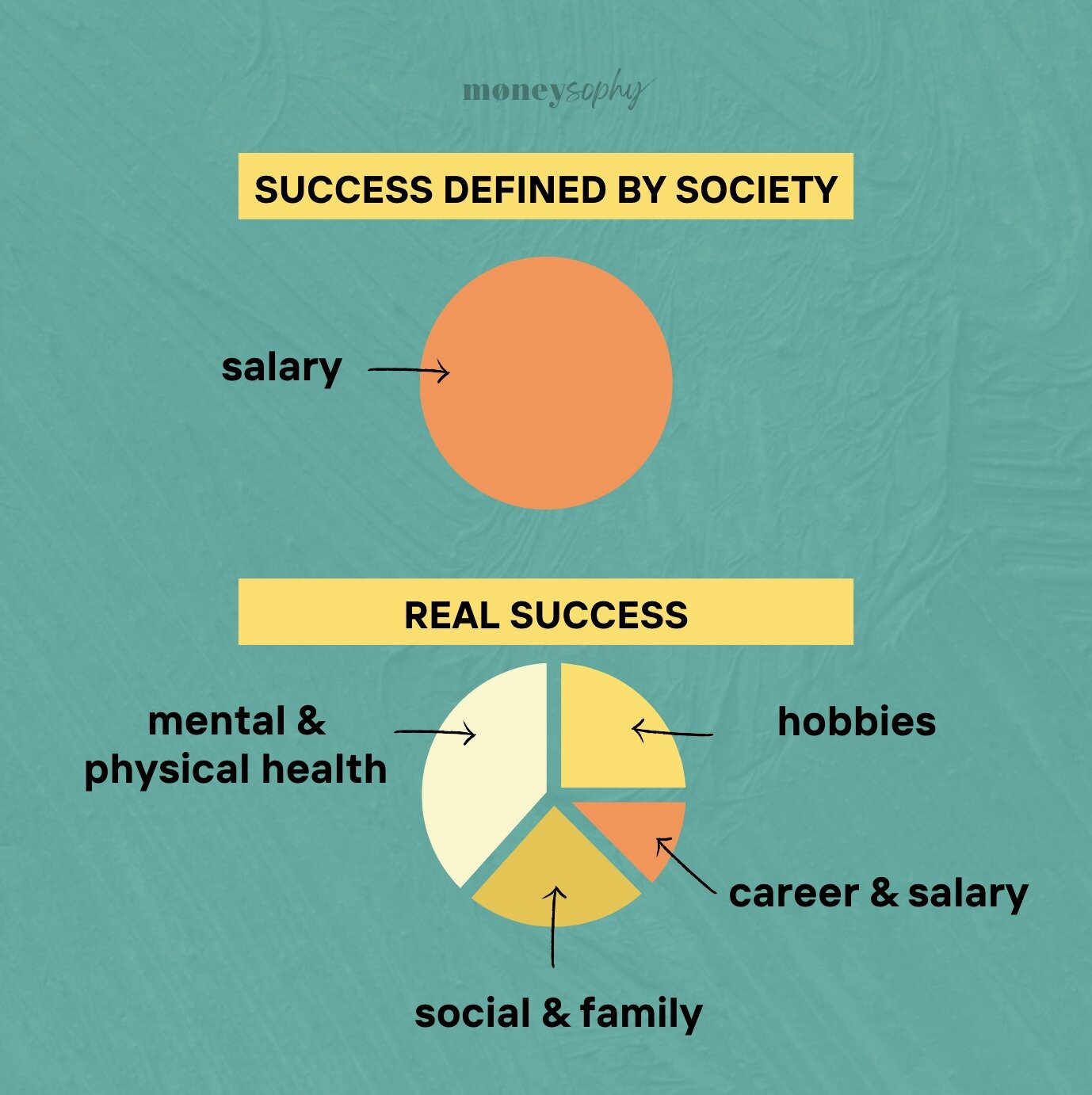

There are plenty of money questions in our daily lives, and no one has ever taught us how to solve them. Traditional financial education is limited to budgeting and investing only, well… there is way more than that. What about the basics such as how much to spend and how to create a payday routine? We need a strategy, not just rules!

That's why I put my 15 years of money lessons at your service, to share the knowledge and practical tools I wish I had known younger so that you can save plenty of time, money and start living your wealthy life TODAY!

FREE GUIDELINES

WE MAKE 35,000 DECISIONS PER DAY. HOW TO TAKE THE RIGHT DECISION EVERY SINGLE TIME?

WE CAN’T!

>> Read why your money problems are NOT related to financial education and 3 exercises to identify your money beliefs to transform your financial habits.

>> Discover the "Ultimate Guideline to Build Your Payday Routine" in just 6 simple steps.

THE SOLUTIONS

O1

TRANSFORM YOUR MONEY NARRATIVE AND BUILD YOUR WEALTHY LIFE

O2

stop living paycheck-to-paycheck & start living your wealthy life

FREE TEST

how do you know how well you’re doing financially?

(Answer the test in 5 questions)

FREE

TESTIMONIALS

DON’T TAKE MY WORDS FOR IT, hear what OTHERS HAVE TO say

STILL NOT CONVINCED?

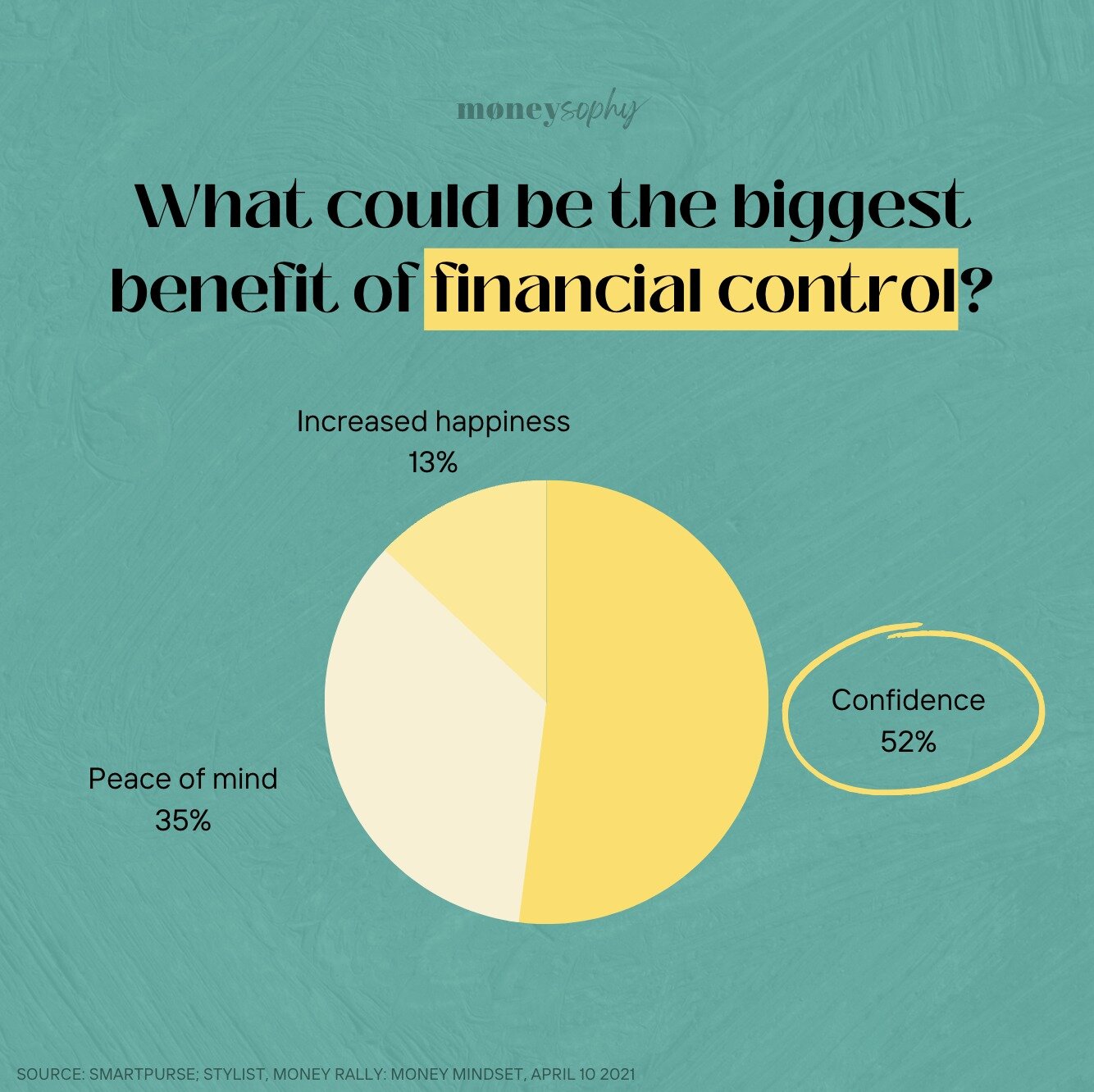

How much is NOT having FINANCIAL CONFIDENCE costing you?

We’re the product of our background, limiting our beliefs and impacting our behaviours unconsciously.

When you don’t have a healthy financial confidence…

You experience guilt, shame or fear

Your future is a guessing game

You’re in the red every month

You fail to implement your financial plan

You don’t actively budget, save or invest

You waste money without thinking

Your finances aren’t aligned with your values

You go on a shopping spree

Subscribe to the newsletter

Subscribe to the newsletter

Not sure yet?

I want to have a first glimpse. Click here.