5 Steps to Build an Effective Financial Wellness Programme in your Workplace

Reading time: 6 minutes

Whether you're just starting out with an employee financial wellness programme or looking to give your current one a boost, this guide (5 steps) is here to help you create a successful initiative that all stakeholders will love! You can thank me later.

And even if you already have a programme in place, you might still pick up some useful tips to make it even better.

Every organisation does things a bit differently, so these steps aren't meant to be followed to the letter. Instead, they're here to give you some strategic guidance and help you tailor your approach to what works best for you.

Agenda

Know Your People: Assess your Employees’ Needs

Align with Your Organisation: Assess your Employer’ Needs

Overcome Obstacles: Tackle the Challenges

Communicate with Clarity: Launch the Programme

Measure Success: Learn & Improve

Assess Your Employees’ Needs

Let's talk about creating a financial wellness programme that really works for your employees.

The journey begins with understanding the unique financial challenges they face.

Think about it: not everyone is on the same page when it comes to financial concerns. Everyone's financial situation is different, and what stresses one person out might not be the same for another.

Financial concerns change a lot as people move through their careers and hit different milestones. Once you have all this data, break it down by age or life stage.

Gen Z: Often focused on managing student loans, saving for a home, learning budgeting skills, making ends meet, and building an emergency fund.

Millennials/Gen X: Typically concerned with managing investment, raising money-smart kids, estate planning and exploring pension options.

So, how do you uncover this valuable information?

Anonymous surveys are great ways to start. Whether online or on paper, they allow employees to share their thoughts at their convenience.

Focus groups are another option, and they can be really valuable because they allow employees to share their experiences and ideas in a more interactive setting.

By tailoring your programme to these different needs, you can make it really effective and beneficial for everyone.

Creating a financial wellness programme that truly supports your employees can be a game-changer. It helps them manage financial stress, improves their overall well-being, and even boosts their productivity.

And that's good news for your business! So, take the time to understand what your employees are dealing with and tailor your programme accordingly. Supporting their financial health is a worthwhile investment in both their well-being and your business's success.

Tip: When asking employees about their financial concerns, make sure they know their answers are confidential. Let them know you'll look at the data as a group, not individually, so they feel comfortable being honest. This will give you the real feedback you need to create a programme that works.

Extra tip: Want to boost participation? Give incentives! Whether it's a bonus for individual participants or a team reward, it can really get more people on board and make the process more engaging. For example, promise a fun perk if 70% of the team joins in.

Assess Your Company’s Needs

Once you've got a handle on what your employees need, it's time to think about how a financial wellness programme fits into your company's bigger picture.

How can it help boost productivity, keep employees happy and on board, and ultimately improve your business performance? Make sure it works well with your existing HR policies and benefits, and enhances the overall experience for your employees.

Setting Clear Objectives

Take a step back and brainstorm what role your organisation currently plays in supporting employees' financial wellness, and what role you want it to play in the future. Set some clear goals to bridge that gap. Your strategy should align with both your business objectives and what your employees need.

Here are some questions to think about:

Vision and Philosophy: What's your vision for employee financial wellness? How does it fit into your learning culture?

Goals: What do you want to achieve with your financial wellness programme?

Alignment: How does this programme support your overall business goals?

Productivity: Financial stress can really affect an employee's ability to focus and perform well. By tackling financial wellness, you can give productivity and efficiency a big boost.

Retention: Employees who feel supported with their finances are more likely to be happy in their jobs and stick around, which means lower turnover rates.

Business Performance: A well-run financial wellness programme can lead to better financial decision-making among employees, which contributes to your company's stability and success.

Want more? Here you have a long list of long-term benefits for your business.

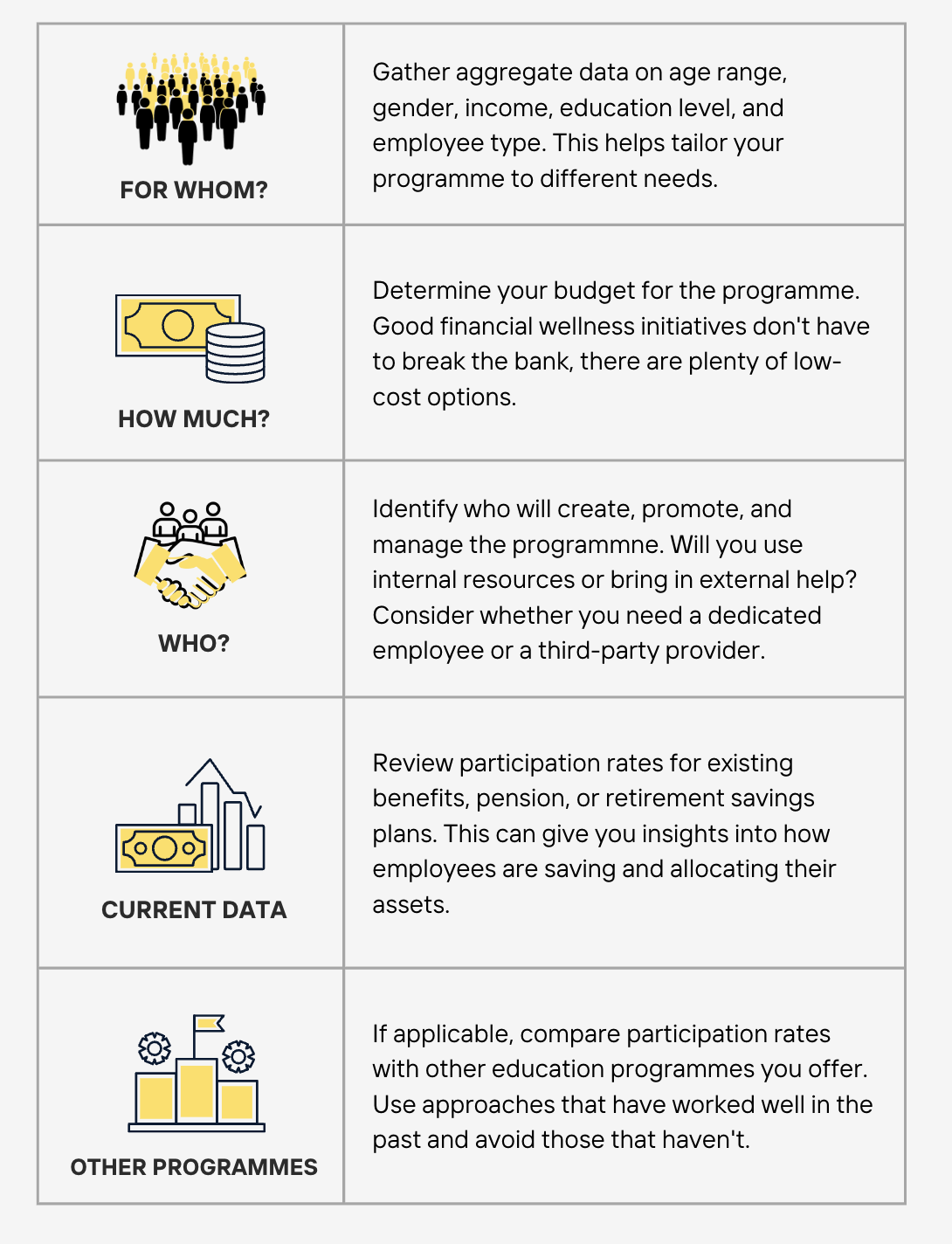

Understanding Your OrganiSational Environment

Grasp a good understanding of your workforce, the work environment, and what resources you have available.

Let's take a look at some of the key things to think about:

Tip: When defining financial wellness and setting objectives, keep your employees' needs front and center. This way, you can ensure that your programme is really relevant and effective for them!

Extra tip: Take a look at any existing financial resources you already have at your disposal! Think employee assistance programs, pension plan consultants, or benefits providers. Make sure these providers are giving you (and your team) genuinely unbiased advice, rather than just pushing specific products. The goal is to get trustworthy, neutral info that your employees can really rely on.

tackle Internal Challenges

You might find that you're short on resources (whether it's time, money, or people) which can really slow things down.

Or hit some roadblocks along the journey: getting senior management on board, difficult employees being critical about money talks, worries about offering reliable impartial advice…

Do what most people don’t: spot any potential roadblocks right from the start!

Without knowing, you can anticipate them and tackle them with strategies to overcome them.

Here's a handy table that outlines some common challenges:

Launch a clear communication strategy (or refresh it!)

Now that you've got your financial wellness programme in place, it's time to spread the word!

Develop a clear plan to promote it effectively. Use a mix of channels like email campaigns, posters, and workshops to generate buzz and encourage people to join in.

Make sure to highlight all the cool benefits and resources available so employees really get what they're getting out of it.

And don't forget to grab the APAC financial wellness calendar here!

Timing is everything! Use real-life events to maximise your impact.

To launch (or refresh) your employee financial wellness programme successfully, here are the 3 key steps:

“Financial education programmes in the workplace will not be a success, if employees are not aware about them. Thus, it is important to use a variety of tools to promote financial education programmes in the workplace. ”

Learn & Improve

Identify Objectives and Metrics

Before you kick off your financial wellness program, know what you're aiming for.

Think about what you want to achieve, like helping employees feel less stressed about money or getting them more savvy about finances.

To see how well you're doing, keep an eye on some key metrics:

Participation Rates: How many employees are actually using the programme.

Financial Literacy Assessments: Test their knowledge before and after the programme to see if they're getting smarter about things like benefits, investments, and budgeting.

Changes in Financial Behaviours: Look for signs that employees are taking action, like saving more, contributing to retirement plans, or getting their debt under control.

Evolutions in Financial Attitude: Are employees feeling more hopeful about their financial future? Are they seeing improvements in their lives and feeling less stressed?

Overall Satisfaction: Do employees feel heard? Do they feel their employers care about them? To what extent they feel more motivated at work?

Share Your Results Effectively

Present your findings using clear visuals to stakeholders, highlighting both the financial returns and improvements in employee wellness. This helps justify continued investment in the programme.

Adapt and Improve

Regularly review feedback and adjust the program to better meet employee needs, ensuring it stays relevant and keeps improving.

Tip: Use Both Numbers and Stories

Quantitative metrics like participation rates and financial outcomes give you the hard numbers. But don't forget qualitative data from employee feedback surveys: they help you understand how the programme is really impacting employee satisfaction and stress levels.

Extra tip: Benchmark Against Industry Standards

Compare your programme's performance to industry benchmarks. This can help you spot areas for improvement and show how well you're doing compared to others.