From Theory to Practice: Get your Payday Routine on track in 4 weeks!

Reading time: 8 minutes

Hi there,

Have you heard of the 50/30/20 budget rule?

It’s a popular way to figure out how to split your monthly income between needs, wants, and savings.

That’s the theory, but how do you actually make it work in real life?

The 50/30/20 split is just a rule of thumb, you must adapt it based on your own lifestyle and what you want to achieve in the short and long term.

No matter where you live, planning for retirement is key—unless you’re sitting on a huge private pension or expecting a big inheritance!

Well once you know the theory, a lot of people still fail to put into practice.

Here are two common pitfalls when it comes to managing money:

NO CLARITY

NO SYSTEM

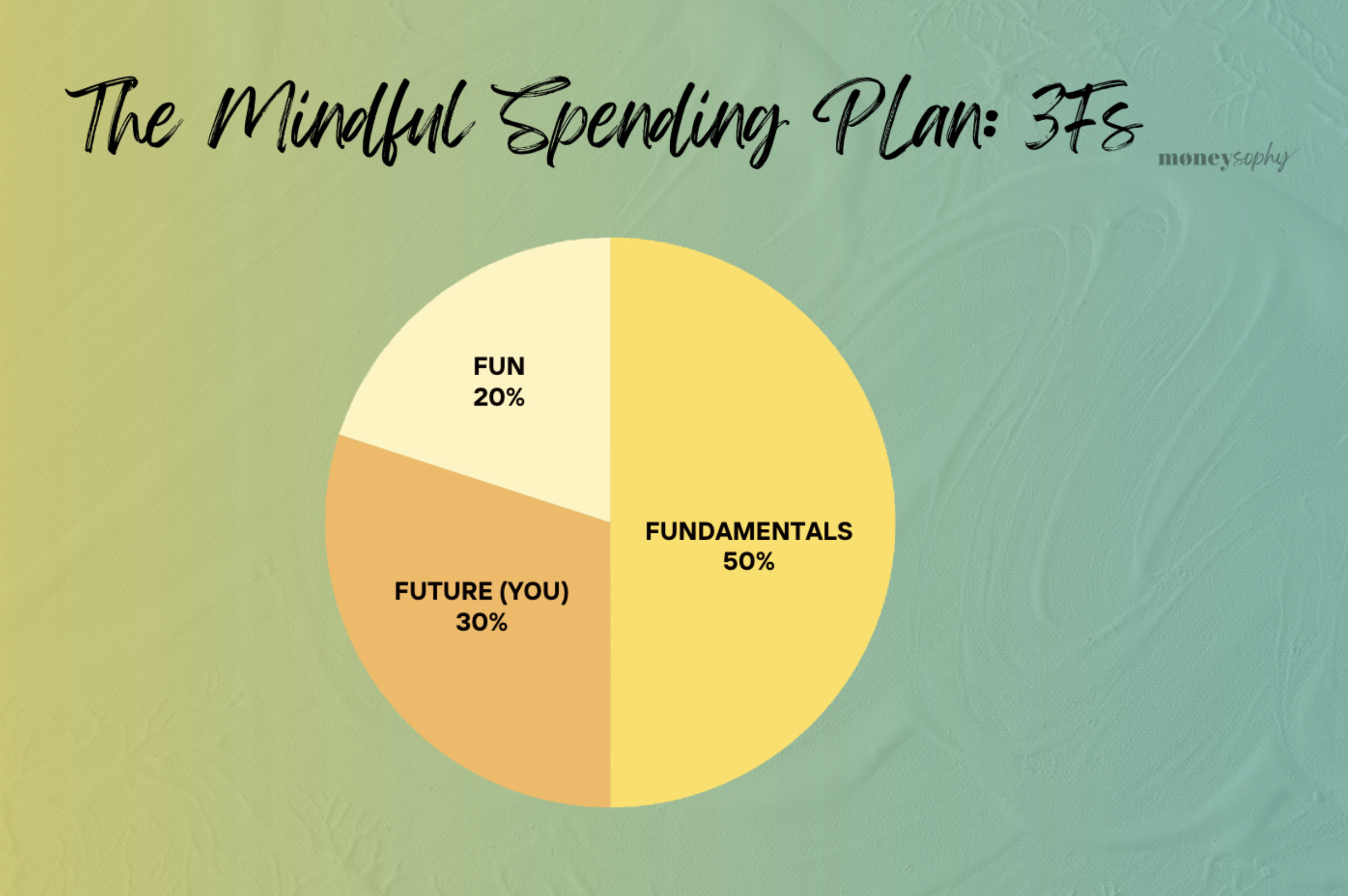

Let me break down the 50/30/20 rule into the Mindful Spending Plan, aka the 3Fs, which stands for:

The 3Fs: Fundamentals - Future You - Fun

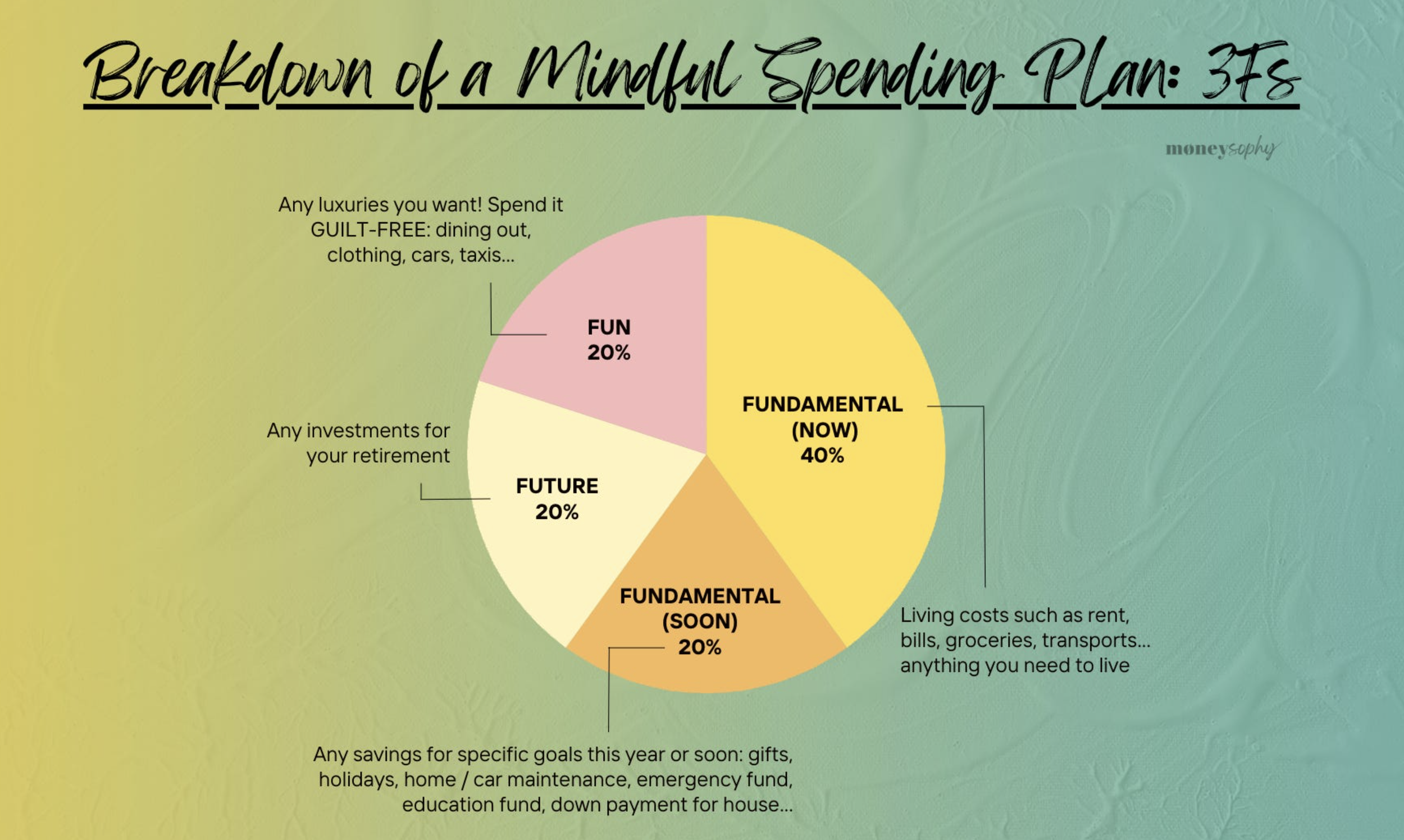

Still, a lot of people overlook the random expenses that don’t show up every month, like your taxes, insurance premiums, birthday gifts, replacing your smartphone, weddings you need to attend, and holiday dinners.

So I’m breaking down the Fundamentals into 2 categories:

Fundamental (now): What I’m spending monthly

Fundamental (soon): What I’m going to spend within a year

Here is what it looks like:

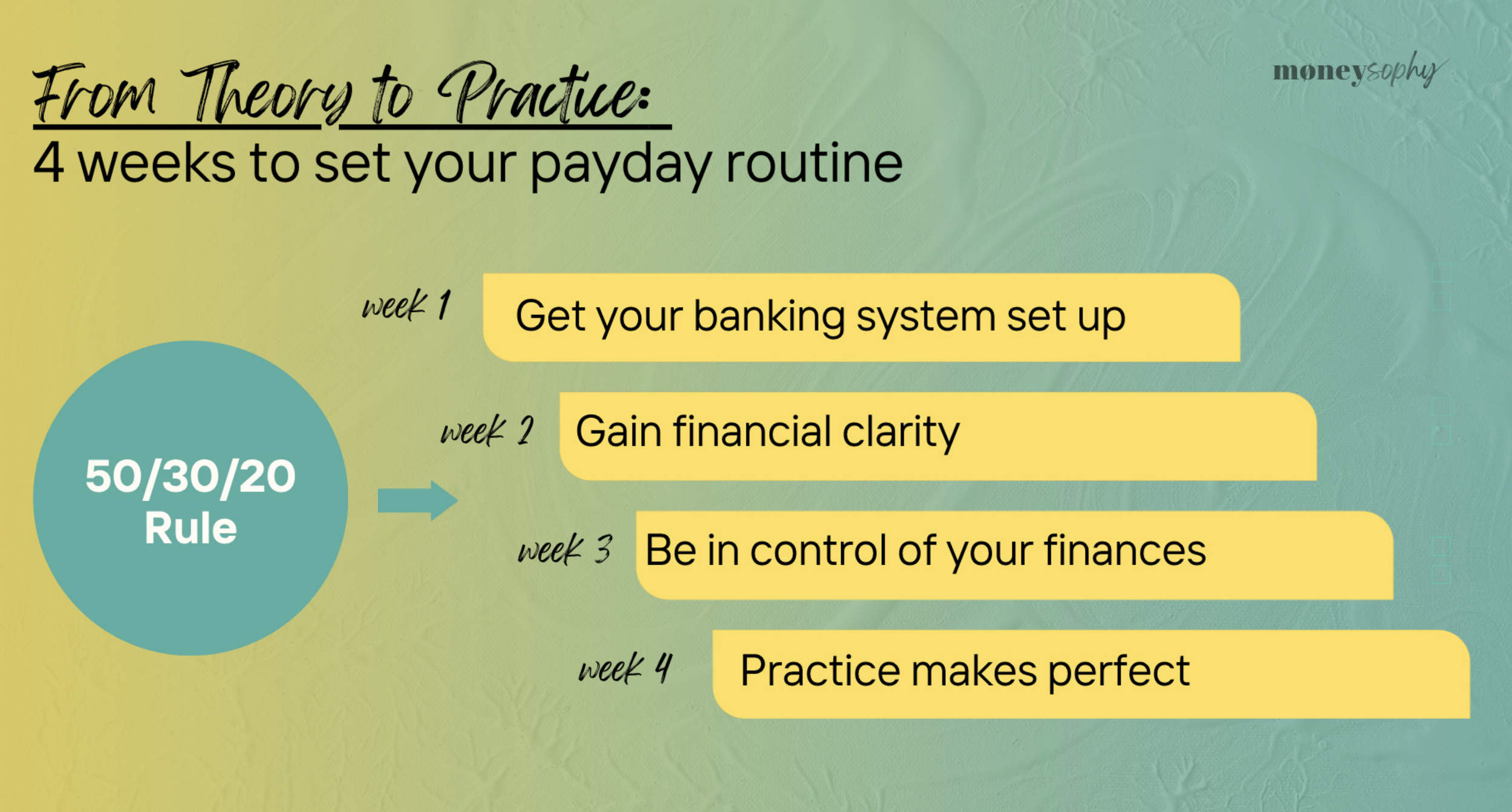

OK, now that you know all the theories, let’s move on to the practice. Here is a step-by-step plan to get your payday routine sorted in just 4 weeks:

Let’s get started!

Week 1: Get Your Banking System Set Up

Credit cards can be your best friend if you know how to use them well. They can score you some awesome perks like “free” vacations and cash back!

But if you’re not careful, they can turn into your worst enemy with crazy interest fees as high as 35% APR!

I often see people making things way too complicated with their banks. They open tons of accounts and cards just to snag a promo or some coupons.

Seriously, stop that! Keep it simple and cut down on the number of credit cards you have.

I only have two credit cards, and honestly, most people don’t need more than that (maybe a third if you run your own business).

Tip #1: Just having a ton of credit cards doesn’t make you rich. I've seen that the messier someone's cash flow is, the more they struggle with money. MAKE IT SIMPLE!

So, how do you pick the right credit cards? It really depends on where you live. Nowadays, most places offer no-fee credit cards with no minimum deposits. Just call your bank or do a quick online search for the best options out there.

(If you live in Hong Kong, here is a benchmark)

Tip #2: If you are paying fees, call your bank and ask them to drop it. If they say no, it might be time to switch banks.

Tip #3: Go for a travel credit card or a cash-back card if you don’t travel much!

Here’s a quick recap:

Step 1: Ensure your don’t pay any fee for using your credit cards (check your bank statement)

Step 2: Check out the list of perks that come with your cards to maximise cash back and miles.

Tip #4: Not sure how to read your credit card statement? Check out my cheatsheet here.

Tip #5: Some banks let you pick your payment due date. Call and see if you can align it with your payday.

Week 2: Gain Financial Clarity

Now that you’ve got your credit card system sorted, it’s time to figure out your cash flow.

You need to know how much money is coming in and going out.

Just grab whatever works for you—a spreadsheet, pen and paper, a calculator or a budgeting app—and go through your expenses from the last month. This shouldn’t take more than 45 minutes. If it does, you might be doing something wrong!

Tip #6: Steal my mindful spending spreadsheet here, if you don’t have a template!

By the end of this, you should know how much you’re spending in these three areas: Fundamentals - Future You - Fun

To recap,

Step 1: Make sure you’re getting paid correctly!

Step 2: Know how much you’re spending on the 3Fs

Tip #7: Think I’m joking? Studies show that 60% of employees find mistakes on their payslips, so definitely double-check that you’re getting paid right after all deductions.

Tip #8: Do this monthly or bi-weekly based on your payday.

Tip #9: You don’t have a regular income? Plan it based on your average income over the last 12 months or the lowest amount you earned during that time.

Tip #10: Don’t forget about your Foundation (soon), i.e. what you’re going to spend within the year, like taxes, insurance premiums, gifts for birthdays, replacing your smartphone, wedding destinations to attend, and those holiday dinners. Keep those in mind!

Week 3: Be in control of your finances

Now that you’ve got a handle on what you’re spending, let’s check if those expenses actually match up with your goals.

Hold up—what are your goals, anyway?

Sure, there is a minority of people who track their expenses every day, but they don’t do anything about it, they just sit on a beautiful spreadsheet, and that’s it.

This is not what I want for you, I want to align your numbers with your goals.

So, grab a pen and make a list of your goals. They can be anything from doing a “no-buy” month to saving for retirement.

Tip #11: Be thorough! You can never have too many goals.

Tip #12: Put a financial number on each goal. For instance, if you want a new smartphone that costs $1,000 by Christmas, you’ll need to save about $250 a month starting in September. Or if you want to save 20% of your income for retirement, just set aside that 20% each month. Easy peasy!

Quick recap:

Step 1: Define at least three Financial Goals

Step 2: Tweak your expenses based on your goals

Week 4: Practice makes perfect!

Now it’s time to keep an eye on your goals—daily, weekly, bi-weekly, or monthly—whatever works best for you!

If you’re super disciplined, checking in once a month might be enough. But if you struggle with that, try checking in weekly or even daily to build a healthy habit and stay on top of your cash flow.

Think of it like working out—you wouldn’t just hit the gym once a month, right?

Quick Recap:

Step 1: Choose a cash flow tracking tool that fits your style (spreadsheet, pen and paper, bank apps, budgeting apps, etc.).

Step 2: Schedule a regular money date—daily, weekly, bi-weekly, or monthly.

Tip #13: Automate your credit card payments so you never miss a due date (and avoid those late fees)!

Tip #14: Set up automatic payments for your rent, bills, and subscriptions to save yourself some time.

Tip #15: Cancel all your subscriptions for now, then add them back one by one to see which ones you actually need.

Tip #16: Leave a little wiggle room between payment dates in case you get paid later than expected.

Tip #17: Find an accountability partner to make it more fun!

So here you, you have your 4-week system to build your payday routine. Hit the reply button and tell me what your #3Fs are!

Let’s boost that financial confidence and take control of your finances!

Sophie

PS- If you know all this and still aren’t taking action, it’s not that you lack financial education; it’s about building financial confidence. Your shadow money archetypes might be holding you back, and there are eight of them. If you missed last week’s newsletter, you can check it out online here and explore which money archetypes are taking control of your finances.