BUILD A payday routine SYSTEM tHAT STICKS

Agenda:

The top 3 payday routine mistakes to avoid

Why do we all need a Payday Routine that works?

How to use the 6Ps of Payday Routine?

Step one: Pay

Step two: Process

Step three: Purpose

Step four: Plan

Step five: Practice

Step six: Persist

Checklist of the Payday Routine

Frequently Asked Questions

The costs of not having a Payday Routine

how to create a healthy payday routine for beginners

The top 3 payday routine mistakes to avoid

#1 NO KNOWLEDGE ABOUT YOUR 3Fs

A common mistake is not being aware of how much you spend. While you don't need to track every single cent, you must know your 3Fs.

Foundation (your needs, aka your living costs) = 50-70% of your income

Future (your investment, aka for your old days) = 10-30% of your income

Fun (your wants, aka your guilt-free spending) = 10-30% of your income

By meeting these 3Fs monthly (more later), you'll be already doing better than 98% of people.

#2 NO CLEAR GOALS

Some people track their expenses, but they don't know what to do with the numbers; they simply sit beautifully on a spreadsheet. That's it.

There is no absolute right or wrong when it comes to money. Your payday routine is truly your own, which means you need to set meaningful goals so that the numbers make sense for you, and you alone (and possibly your family if you have dependents).

Ask yourself questions such as:

What are you saving for?

What kind of life and retirement do you dream of?

Who do you want to share these moments with?

It’s OK if you don’t have all the answers yet, but not asking = not even thinking about it.

I’ve been asking myself for the past 10+ years and keep asking what I want in life. That is the secret to creating my purposeful wealth.

#3 NO SUSTAINABLE PAYDAY ROUTINE

Most people don’t have a budget

Most people don’t know what to do with their income

Most people can’t keep up with a payday routine because they overcomplicate it.

Throughout our lives, we have been told “save more”, “invest early”.

But we are NOT told how (and how much) to spend, save and invest in an easy and practical manner.

That’s why I developed the 6Ps of Payday Routine, with provides all the necessary tools to help you get started. This framework is everything I wish I had known when I started my financial journey, and I have successfully used it to assist my clients in establishing healthy payday routines that they can keep it up.

By following this ultimate guideline, you'll learn the invaluable tips and tricks to simplify your payday routine and stick to it like a pro.

Why do we all need a Payday Routine that works?

People constantly:

make the wrong financial decision-making

live paycheck to paycheck

feel stressed & uncertain about purchases or investments

Because…

1. People are afraid to look at their bank app or worry about the future. They focus on external factors such as the economy and complain about their low paycheck.

If you find yourself in this category, building your financial confidence before diving into your payday routine may be helpful [read my blog article about the the power of money beliefs here].

2. People dont have a solid payday routine. They aren't sure how much they earn, where their money goes, or how to plan for the future.

not realistic = not sustainable in the long run

3. People don’t manage their finances because they haven’t found a system that fits their lifestyle (if they even have one to start with).

If you don't have a sustainable system in place, it's similar to signing up for a local gym and only showing up three times. Just like in sports, consistency is key to achieving results.

Did you know that?

What is the 6Ps of the Payday Routine?

A universal and actionable methodology for a successful money management system from the day you’re paid to your next paycheque FOR FREE!

PAY - check your payslip

PROCESS - assess your last spending

PURPOSE - define the SMART goals

PLAN - create a clear roadmap

PRACTICE - apply it daily

PERSIST - practice makes it perfect

How to use the 6Ps payday routine?

To keep it simple, I’ve created a 6-step process to have a solid payday routine.

It shouldn’t take long. The first time you do it, it might take a bit longer to establish all the steps, but once you know, it should take between 30-45 minutes per month.

Each session includes:

Warning: The 6Ps method is effective only if you've built your financial confidence. Without it, any additional financial education will have limited impact to your personal finances.

Don’t know how well you’re doing in terms of financial well-being? Take the Annual Money Health Check test here to gain clarification.

Step 1: Pay

ObjectiveENSURE YOU ARE ACCURATELY PAID SYSTEMATICALLY

StepsEvery time you get paid, look into the details of your paystub as follows:

STEP 1: Double-check the gross pay, specifically those who are paid hourly, to inspect that no mistake was made.

STEP 2: Verify calculations on each line, including bonuses, taxes, or any other deductions applied to your pay.

Pro TipsFor anything related to your payslip, from the calculation of pension contribution to the coverage of your health insurance, ask your HR to explain; they usually like to share what they know, a win-win situation.

Automate money transfers to a separate account to avoid spending anything you didn't plan to (after payment of all your dues).

Extra MileConsult a Tax Advisor to optimise your taxes

Fun fact60% of employees have identified mistakes on their payslips (source: 2019 Study on 2,000 individuals in the UK, by Zellis)

Step 2: PROCESS

ObjectiveASSESS YOUR LAST CASH FLOW LIKE A PRO

StepsAll your payday routine efforts are wasted if you don't use the data, so block the time on your calendar and ask yourself the right questions:

STEP 1: Pull out your last spreadsheet or whatever you use to track your cash flow and compute your expenses.

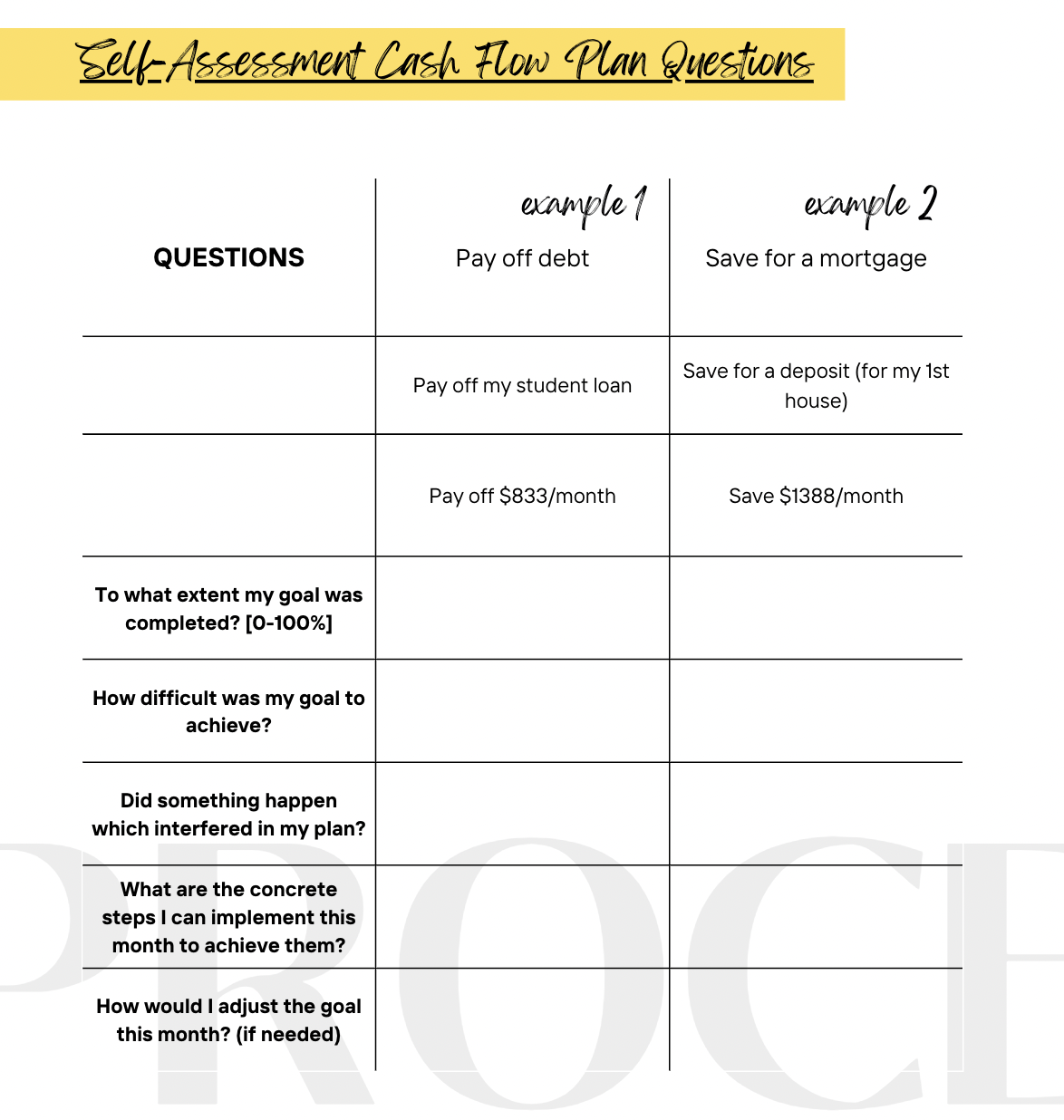

STEP 2: Assess to what extent you have accomplished your financial goals:

If you have underspent from your cash flow plan, great job, you have extra for your savings!

If you have overspent from your cash flow plan, it's essential to understand the reasons why and avoid repetitions!

> Check the “self-assessment questions” below to get started

Pro TipsDon't forget to double-check your bank statements to see if you have not missed any expenses.

There is no need to track every penny, instead, consider adding a 5-10% buffer to your budget for miscellaneous expenses like toiletries, dog toys, or pharmacy drugs.

If you just started out and have yet to set any goals - no worries, skip this step and start from next month forward!

Extra MileEach spending objective is attached to a longer financial goal so that you choose your today's lifestyle accordingly versus going with the flow attitude.

Fun fact61% of Americans don’t have a budget (source)

"What GETs measured,

gets improved"

Step 3: PURPOSE

ObjectiveDEFINE YOUR SMART GOALS FOR A WEALTHY LIFE

StepsWithout a direction, you get lost. This is the most essential step, which is knowing what you truly want. You might not know what you want precisely financially, but you most likely have a few ideas, so take your time and reflect on your short-, medium- and long-term goals. This will act as the compass for the whole payday routine.

STEP 1: Define at least three SMART Financial Goals

> Check the "Smart Financial Goals Table” below

STEP 2: Every time you remind yourself of your goals, you train your brain to make them happen - journaling your goals, saying them out loud, or pin them on your desk/screensaver.

You started this payday routine for a reason, whether it's to track your cash flow, reduce your shopping budget, save more, or increase your investment portfolio.

Be SMART!

Pro TipsBe as exhaustive as you can, jot down all your goals.

Get inspired with the list of common goals below:

Reduce overspending on shopping, smoking, alcohol, luxuries..

Ensure your spending reflects your goals and values

Stay on track toward your financial goals

Stop the paycheck-to-paycheck cycle

Save money for kids' education

Build an emergency fund

Live below your means

Save for retirement

Save for vacations

Get out of debt

Buy a phone

Buy a house

Buy a car

Extra MileAdd an "Opportunity Cost" row in the table, which answers the question "What am I missing out on if I don't realise it?" Sometimes knowing the cost of not doing what we want makes our brain more alert and more willing to achieve the right action.

Add a "System" row in the table, which answers "what is THE system I can create that will make my goals reachable?" To save X amount of money, we must reduce our expenditure from elsewhere. What are you willing to give up to achieve your goals: your UBER rides, daily takeouts, binge drinking with friends or shopping the latest trends?

Fun factSaving for retirement is the financial priority for one-third of Hong Kongers (source: 2021 Study on 1,034 individuals in Hong Kong, by Manulife)

Step 4: PLAN

ObjectiveCREATE A MINDFUL SPENDING PLAN WITH AUTOMATION

StepsNow that you have all your goals, you want to ensure you keep on track of your progress:

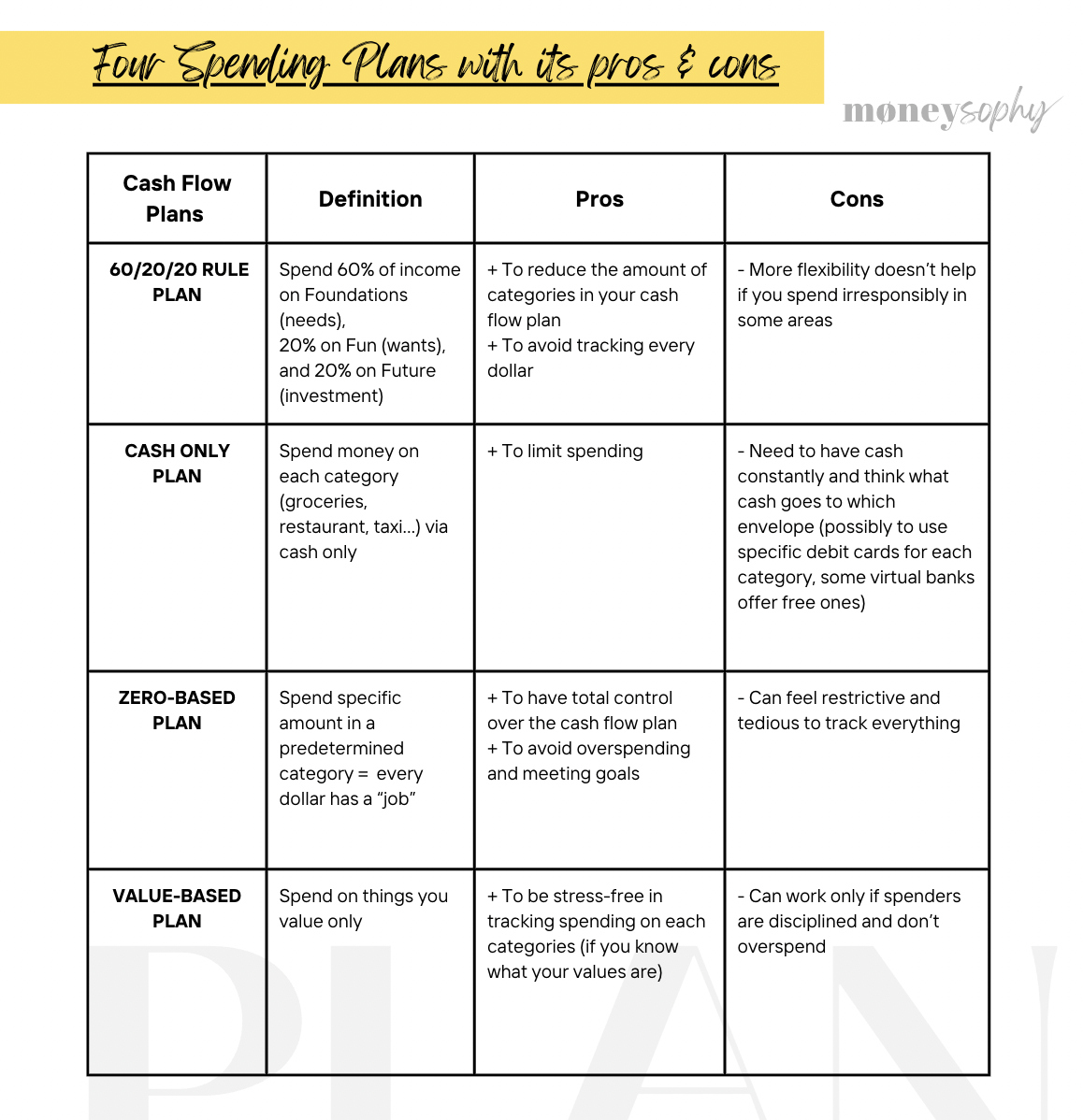

STEP 1: Pick a Cash-Flow Plan that works for you

> Check the "Four Cash Flow Plan and its pros and cons" below

STEP 2: Allocate your spending per category (3Fs) monthly

> Check the "Breakdown of a Mindful Spending Plan" below

Before you run away as soon as I mention the "devil” word, let me define a Mindful Spending Plan, and what it is for (or budget for the most traditional).

A Mindful Spending Plan is a system to gain financial clarity.

It doesn't sound sexy at all, but it is IN-DIS-PEN-SA-BLE to understand where your money goes and have control of your money (as opposed to money controlling you!).

If you want to lose weight, there are only two things to make it happen: decrease your caloric intake and/or increase your calorie burn. Likewise in a Mindful Spending Plan, if you want to increase your savings, you either boost your income or cut your expenses.

There are many ways to track your spending, and no right or wrong ways to do it. If you don't have a system yet, try a few for the next couple of months to test which suits you be.

Want a template? You can get mine for free here.

Pro TipsAutomate your savings as soon as it reaches your account, so you won't be tempted to spend the money.

> Check the "Priorities Pyramid" below

Here are three other ways to pay yourself first:

Save in a separate savings account

Invest a portion of the money

Purchase a book/course for personal development

Use a calendar to catch irregular expenses such as:

Special occasion related events (Xmas, Birthdays, gift-giving holidays)

Annual insurance premiums (home, car, health..)

Annual vacations

Taxes (property, income…)

Annual medical exams

Direct deposit is great to not forget a payment, but you might forget which payments are done in which day. Pin down payments on your digital or physical Calendar (template here) to avoid any bad surprises.

Extra MileEach country has its own credit score or creditworthiness system, so find out what the rules are to improve your score/worthiness in the eyes of the banking system such as payment behaviour.

Why is it important? To stay on top credit tier make you eligible to request a mortgage/business loan, get better interest rates and in some cases, get an apartment rental or even a job!

Fun factFear keeps 55% of Americans from monitoring their bank account as regularly as they should (source: 2021 Study on 2,000 individuals in the USA, by OnePoll)

Step 5: PRACTICE

ObjectiveSPEND INTENTIONALLY ON A REGULAR BASIS

StepsSTEP 1: Pick a Cash Flow Tracking tool

Apps (Monefy, YNAB, Everydollar, PocketGuard, Planto...)

Spreadsheets (Excel, Notion...)

Pen and paper

> Check the "Cash Flow Planning Tools and its pros and cons"

STEP 2: Jot down all your spending on the chosen tool for the month

Pro TipsYou can also mix and match the tools, such as note-taking all expenses through an app and export the data to a spreadsheet at month-end.

Do it daily or weekly to save plenty of time. If you procrastinate until the end of the month, you will take 10x more time to do it.

Don't forget to verify your bank statements to see if you have not missed any payments - it's also a great way to be reactive in case of fraud (e.g. the overpaid tips at a restaurant, a wrong transaction…).

Extra MileIf you live with a partner or a family, schedule a regular household Money Date. This step is a team project. If your partner doesn't want to be included in the project, you can then give a limited budget for each category, but it's best to involve all parties from the beginning of the payday routine journey.

Fun fact70% of Millennials use budgeting apps (versus 25%of Generation X only) (source: 2018 Study on 1,626 individuals in the USA, by CivicScience)

Step 5: PERSIST

ObjectiveREPEAT ENDLESSLY UNTIL IT BECOMES A REFLEX

StepsBuilding new habits can be daunting and challenging. The Payday Routine Framework was designed through an evidence-based and behavioural change intervention lens, which guarantees its success. A specific accountability partner increases your chances of achieving your goals by 95%, hence:

STEP 1: Schedule an hour money date monthly with yourself, a partner, a friend or a Money Coach, acting as an accountability partner and a practical guide

STEP 2: (Co-)Design solutions to tackle all challenges

Pro TipsRepetition is key for success. Doing the 6Ps once is a good first step, but the hardest part is to keep doing it when you are NOT motivated, hence the monthly Money Date with yourself or an accountability, don't postpone it unless you have a valid reason!

If there's a significant difference between your current expenses and your ideal expenses, it's beneficial to gradually adjust your spending habits in a healthy manner. Think of it like a diet: you don't want to make drastic changes in your eating habits to quickly lose weight, as there's a high chance of rebounding and gaining even more weight (hello, yo-yo dieting!). Instead, aim for gradual weight loss/expenses cut to sustain your diet/spending in the long run.

Extra MileList all potential threats that might block your action plan so you can anticipate them better:

Shopping frenzy

Procrastinating my daily/weekly tasks

Drinking which leads to smoking more and drinking more when socialising, meeting up with friends picking expensive restaurants, buying takeaway, taking too many taxis etc.

Fun factA scientific study stated that forming a new habit takes between 18 to 254 days (source: 2010, "How are habits formed: Modeling habit formation in the real world", European Journal of Social Psychology)

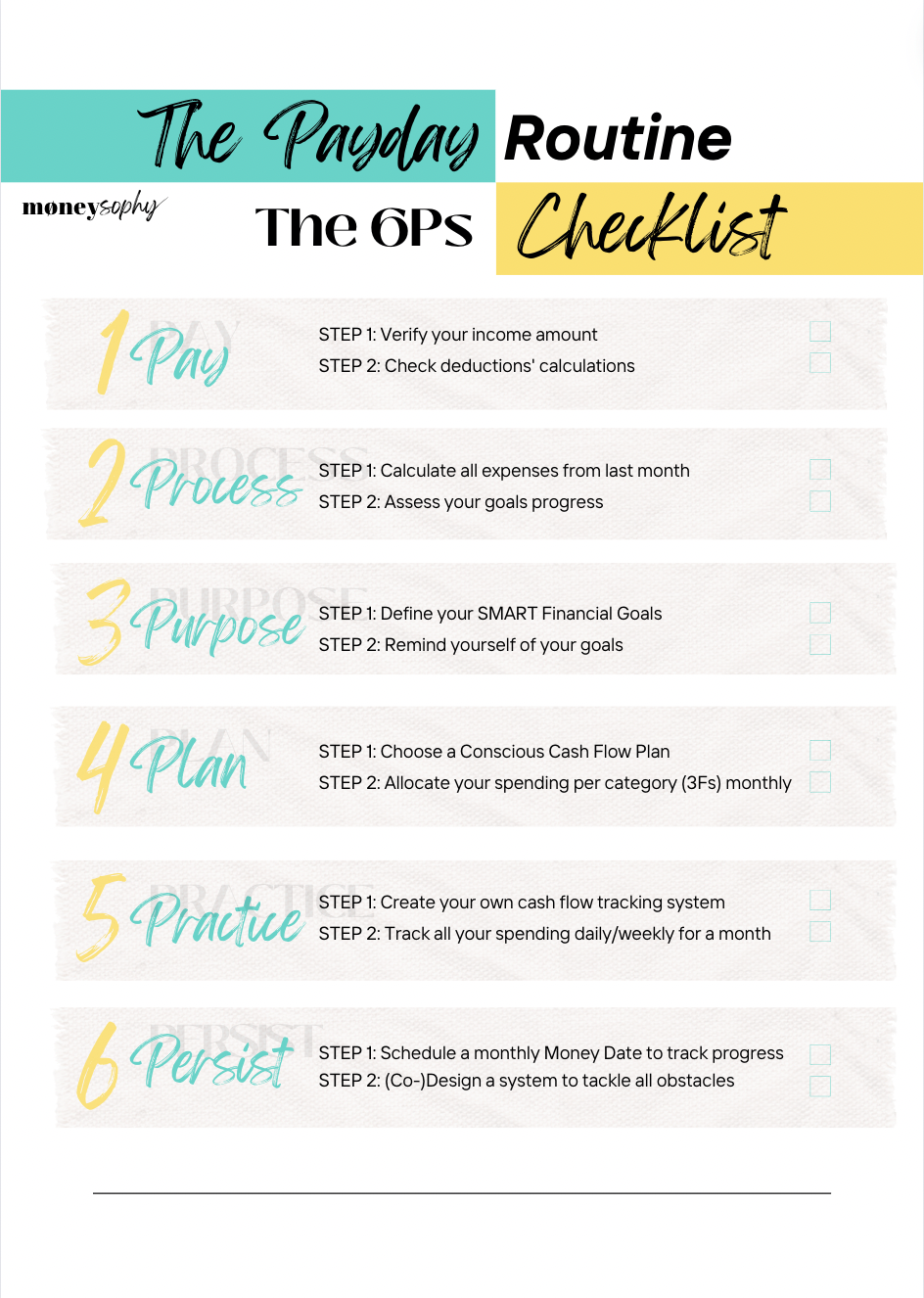

Checklist of the Payday Routine

PAYSTEP 1: Verify your income amount

STEP 2: Check deductions' calculations

PROCESSSTEP 1: Calculate all expenses from last month

STEP 2: Assess your goals progress

PURPOSESTEP 1: Define your SMART Financial Goals

STEP 2: Remind yourself of your goals

PLANSTEP 1: Choose a Conscious Cash Flow Plan that works for you

STEP 2: Allocate your spending per category (3Fs) monthly

PRACTICESTEP 1: Create your own cash flow tracking system

STEP 2: Track all your spending daily/weekly for the month

PERSISTSTEP 1: Schedule a monthly Money Date to track progress

STEP 2: Design a system to tackle all obstacles

Frequently Asked Questions

-

If logging into your app triggers stress or anxiety, it could indicate unresolved fears or concerns regarding money and spending.

Money beliefs are often established during childhood, which shapes our automatic money behaviours today.

You can schedule a FREE call with your me to see how I can help. As a specialised Money Coach, I provide alternative financial education to help individuals overcome their money challenges and build financial confidence.

-

Regardless of your paycheck size or timeline, you can still use the same Payday routine Framework. Just adapt it accordingly.

If your payday is not regular, grab a monthly calendar and put down your payday and all your dues.

If your payment is not the same amount, use an average of your income for the last 12 months by estimating as a reference point and adjust as needed.

If you are your own boss, dissociate your personal from your professional bank account expenses, use different credit/debit cards, and track all receipts for work (you can use apps such as Expensify to store all of them) for tax purposes.

-

There is no secret. You only have two options.

Option 1: Cut out items on your Foundations and Fun (wants and needs). Think if you can shop cheaper elsewhere? Can you opt for a bill or a subscription for a better rate?

Option 2: Increase your income if you have maximised the reduction of your expenses.

If you encounter any financial issues, email me via hello@moneysophy.com to see how I can help.

-

Schedule a regular household meeting addressing money. If you live with a partner, the Payday Routine Framework is a team project.

After all, money is the number one issue in couples. Yet, if your partner doesn't want to be included in the project, you can then give a limited budget for each category, but the ideal scenario it's to involve both parties from the beginning of the payday routine journey to build a future together.

-

You aren't alone.

Anxiety, stress and fear regarding money are common in today's society. The fact that money is a taboo subject contributes to the financial stress cycle.

Don't remain silent; schedule a FREE call with me to share your challenges so that I can help guide you in your thoughts.

-

It depends on how active the bank accounts are. Do you use them for your daily expenses? Do you use them for specific online purchases? Do you use them for investments?

You either use different cash flow systems for each country's bank account or incorporate all expenses on one central cash flow tracking system.

I have investments in different countries so I one for each country.

If you have any questions, email me at hello@moneysophy.com

The costs of not having a payday routine

If you don’t have a payday routine, you will have…

No clarity and peace of mind

No mindful spending

No purposeful saving

No automatic investments

No financial confidence

No financial empowerment

The 6Ps of Payday Routine, regardless of your income level or location, is a structured and regular methodology that provides financial clarity. It acts as a compass to evaluate your current and future financial situation, while leaving room for flexibility.

Think of it as a training program, where you receive a proven methodology that can be customised to suit your preferences.

Hear what others have to say

KNOWING IS BETTER THAN GUESSING.

Want a copy?

A free e-book with practical insights for simplifying your financial world and living well.