Automationphilia: sit back, relax and let automation take over!

Now that you've identified the limiting money narrative holding you back and set up your money management system with a killer payday routine, it's time to take it to the next level: automation.

Automation is my jam. I love automation - this is the secret to free yourself plenty of time to do things you love.

This is also one of the 3 biggest mistakes people make when living paycheck-to-paycheck. Remember, the other 2 are lack of guidance and lack of a plan. If you want the full scoop, check out the article here.

Today, I'm going to break it down and show you how to automate everything like a pro. We'll be working with the numbers of the Mindful Spending Plan: 40/20/20/20 - but remember, you can always customise them to fit your needs and wants.

Before we dive in, let's quickly recap the 3Fs of spending: Foundation (Now+Soon), Future & Fun.

Now that you know the theory, how does it work every month at payday? With the automation system, you will now believe me when I tell you that your money matters should not take more than an hour each month. With the right tools and systems in place, it becomes a breeze :)

Today is March 3rd, and you should have already been paid for all your hard work in February. So, what do you do?

If you missed last week's newsletter, read it; otherwise the Mindful Spending Plan won't resonate with you.

It's the month of March and we reach 9 degrees in Hong Kong, I'm planning to move to Singapore, where it's summer 365 days a year! Anyone from there?

Today's agenda

- It's payday!

- Pay for your living costs

- Save for upcoming expenses

- Invest in your future self

- Live your wealthy life

First things first, simplify your system.

I've seen way too many people with these crazy complex systems involving a dozen credit cards - enough to make me fall off my chair. Please do yourself a favour, keep it simple.

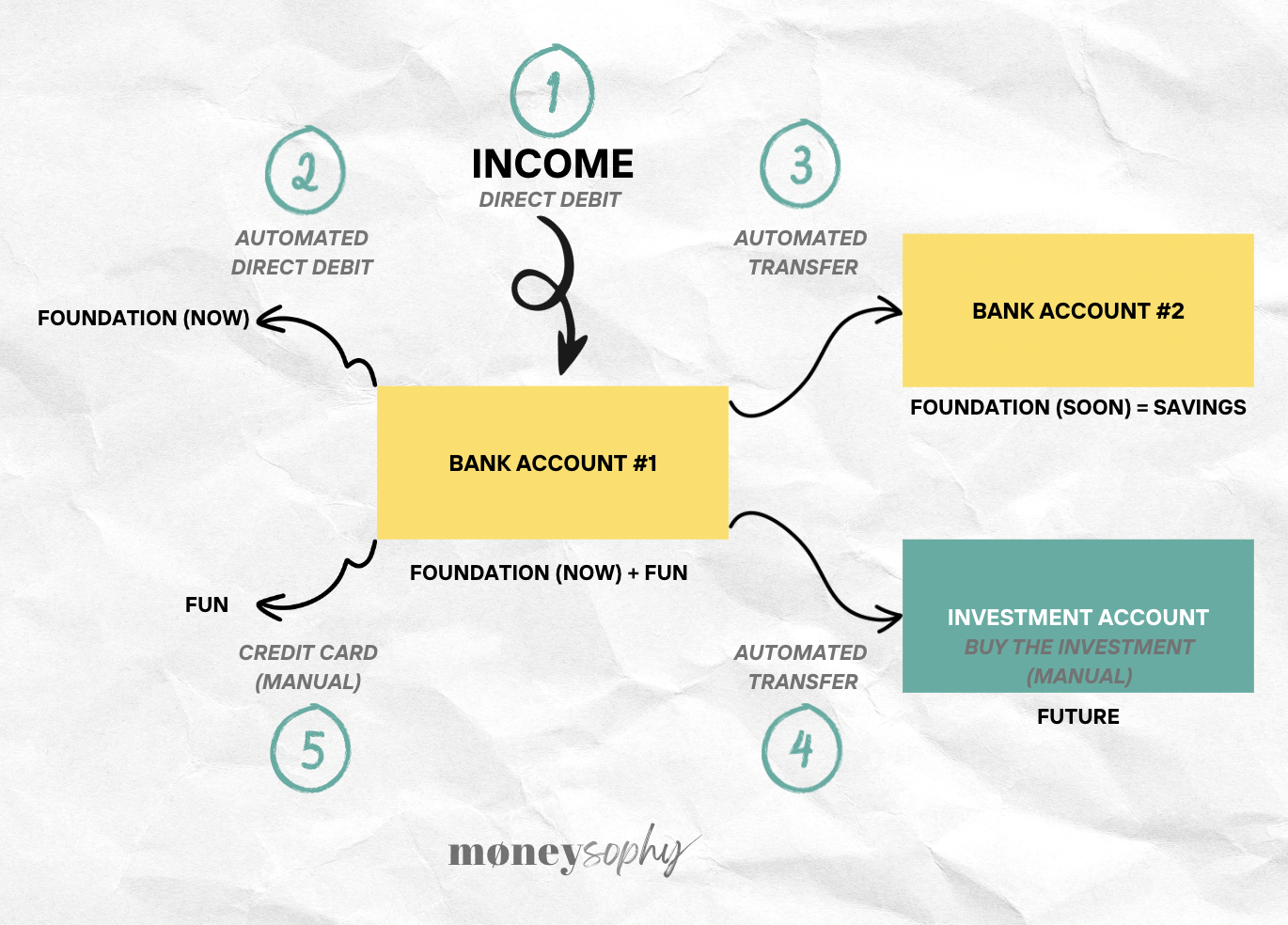

My system requires 2 bank accounts, 1 investment account, and 1 credit card (see blueprint below).

It's payday!

Do you happen to have any extra money before receiving your paycheck? Awesome! Go ahead and transfer it to your saving account!

Now, you have received your income directly into your bank account. Remember step #1 of the Payday Routine: have a reflex to check if the amount is correct!

Pay for your living costs

It's time to take care of your living expenses. This includes your rent, bills, subscriptions, taxes, insurance, credit card debt and other obligations.

The goal is to automate everything. It's best to have all your payments scheduled for the same day each month - you can request this from companies. My ideal due date is the 1st of the month, so I start fresh. Be cautious with the last day of the month due to sneaky variations in the number of days (28 to 31).

When you've got everything automated, life becomes a whole lot easier. All you need to do is double-check to make sure those direct debit didn't increase unexpectedly.

Save for upcoming expenses

I've set up a recurring transfer of 20% of my paycheck to another bank account every month. That account? It's my savings account: to stash away money for any expenses I foresee in the next three years. Think emergency fund, dream holidays, that shiny new phone, and even gifts.

This single habit will make you financially safe, and keep you away from debts!

Find an account that can give you a sweet 3-5% interest per year. You want super low-risk + ability to withdraw that money at any time. By separating your savings into this special account, you are creating a barrier. It's like a fortress protecting your money, making it less likely for you to touch it for any other purpose. Build this discipline and you will thank me later.

Invest in your future self

Take advantage of fantastic tax advantages for retirement plans, and don't forget about potential contribution matches from your company. Or if you're lucky enough to live in Hong Kong, Singapore, Malaysia, Switzerland, Sri Lanka or New Zealand, you won't be taxed for capital gains.

Maximise your investment potential!

How to automate your investment? I've set up a recurring transfer of another 20% of my paycheck to my investment account every month. I personally use Interactive Brokers but there are many others (I won't dive into the nitty-gritty of investing here - we can save that for another newsletter if you're interested - but let me tell you this: consider either a target-date fund or a diversified portfolio of ETFs).

While transferring my money is automatic, I still need to manually invest it in the app. Now, I know there are other apps that can do this automatically, but personally, I'm cool with spending less than 2 minutes to get it done.

Live your wealthy life

Now, the money left is all for you to enjoy your daily life and have fun spending. You can spend confidently on whatever you value the most, as long as it stays within the leftover you've set for yourself (~30% of your income).

No more overthinking or second-guessing whether you should buy something or not. No more questions such as: Is it reasonable? Does it make financial sense? Instead, ask yourself: 1) Do I like it? 2) Do I have money in my fun enveloppe? If the answer is "hell yes", just buy it stress-free, guilt-free, worry-free!

Boom! There you have it – your rock-solid automation system is all set up, and you know exactly what steps to follow. I told you it will take less than an hour monthly to deal with your finances.

This is also the secret to living a mindful wealthy life. Enjoy the present while building a wealthier future.

So keep growing that financial confidence. Make automation your second nature. Live your wealthy life today and tomorrow.

Sophie

PS - if you're interested in Investing 101, or how to decipher you banker's sales pitch, hit reply to this email and tell me what you want to know exactly, so I can write a better newsletter for you.