Our beliefs create our reality

For the next three weeks, I will be sharing concrete actions that you can take to build your financial confidence from the comfort of your home, based on my 3 coaching pillars: AAA - Awareness, Action, (h)Abit.

Each week, I will share specific actions and how they have helped a client, with the hope that their example will inspire you to do the same.

If you have been following me for some time, you know that I often talk about money beliefs (like here or here). There is a reason for that.

Money beliefs, though invisible, are loud! They are the inner voice that dictates our financial actions without us even realising it.

Why?

When we truly believe something, our brain goes all-in, collecting every piece of evidence that validates our belief and filters out anything that contradicts it.

After countless internal dialogues, eventually, that voice stops being "just a voice." It transforms into a belief. And it becomes our reality.

Yes, it's the same belief that can cause daily financial stress, impulsive online spending, or denial when it comes to savings or investments.

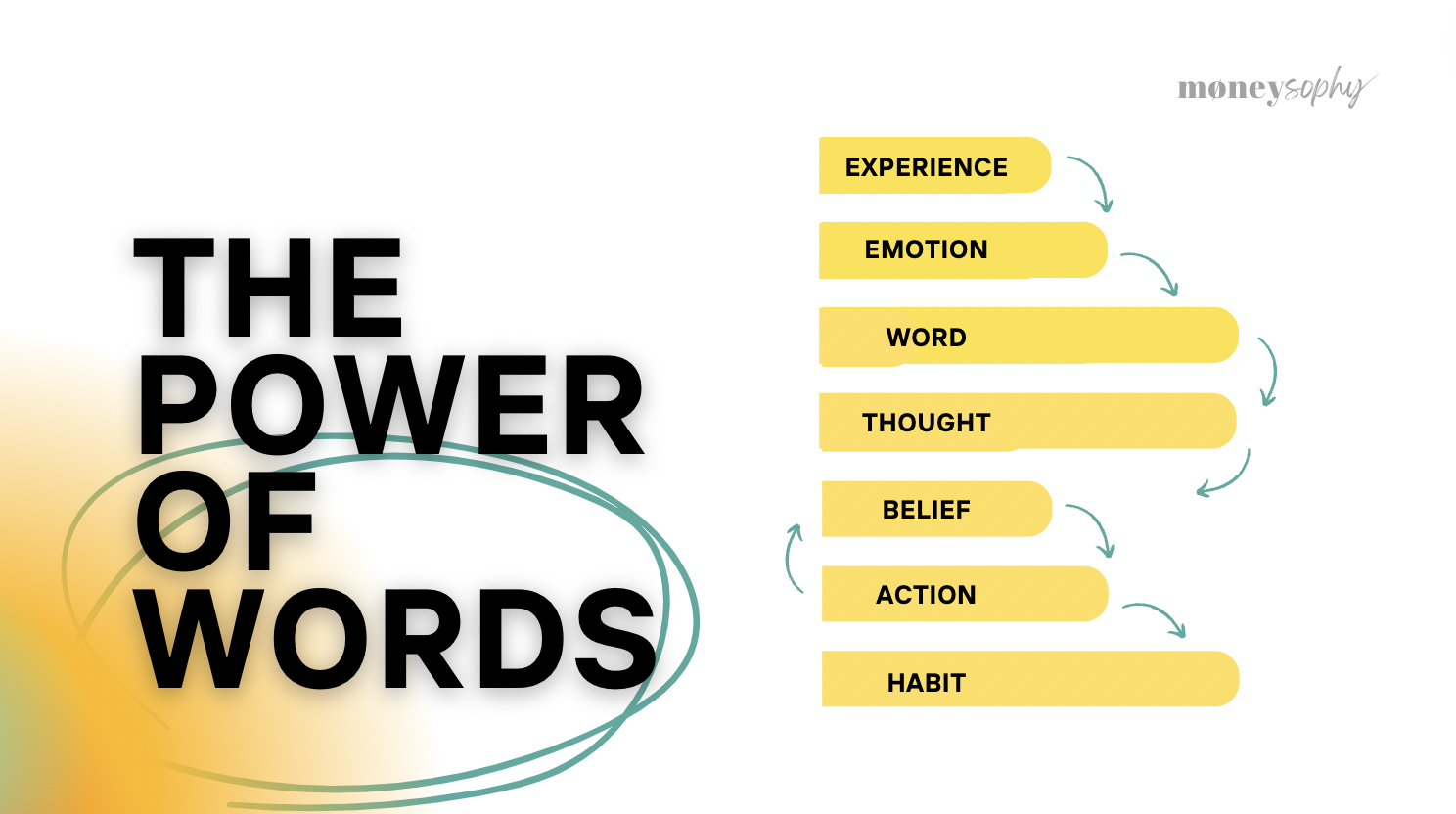

The correlation between emotions, beliefs and actions

So, what can we do today to transform our deep-rooted money beliefs?

I'm sharing three tips to develop your mental performance like a pro.

Today's Agenda

- Label the emotions

- Slow down

- Practice your mental performance

Label the emotions

Let's take the example of my client, Dan.

Dan is a 43-year-old C-level executive and the main breadwinner in her household. Dan enjoys splurging and spoiling her loved ones. She buys things to justify why she works so hard. Dan likes fashion and often shops online. Sometimes, she ends up spending $15,000 in an e-boutique without even realising it until the package arrives. She feels a mix of guilt for buying unnecessary items, as she only wears about 50% of them, but she can't be bothered to return them for a refund. Dan came to me because she wants to start investing for her retirement, as she currently lives paycheck-to-paycheck.

The thing is, when Dan shops, she is on autopilot. She does it without consciously realising it (you know like when you're brushing your teeth when you wake up or endlessly scrolling on social media when you're on your phone).

As shown in the image, emotions and actions are connected. To understand why we engage in certain actions, we need to go back to the source: our emotions.

What can you do? Keep a journal where you connect the dots between life events, the emotional rollercoaster they put you through, and the thoughts and behaviours they trigger.

It's all about self-awareness and understanding the patterns that shape your actions. Life events can include work episodes, financial stress or fear, triggers with friends or partners, or even past events.

In Dan's case, she realised that she turns to online shopping whenever she procrastinates. It's a way for her to escape preparing for work negotiations or dealing with administrative tasks for her son. Reaching out to her favorite boutique and getting that dopamine hit makes her feel better, less stressed, and provides her with a sense of pleasure instantly!

Slow down

Last week, I had a chat with Parenting Coach Anne-Laure, we discussed the neuroscience behind our behaviours (watch it here).

Long story short, we have "two brains" that dictate our actions:

- Thinking Brain (aka Prefrontal Cortex) - think logically any situation, can name emotions, but takes longer to reactEmotional

- Brain (aka Limbic System) - get triggered and emotional, out of control and react instantly

Your brain often operates on autopilot, activating your emotional brain, so of course you're not in control!

You must SLOW DOWN!

Have you ever said things that you later regret it?

This is exactly why we're often advised NOT to engage in discussions when we're feeling triggered or when we "don't have a clear mind".

**Take a deep breath, meditate, go for a walk, call a friend, exercise, or find a method that works for you to take a break for a minute or two from that emotion. **

In Dan's case, every time she reaches for her phone or computer, she stretches her limbs. This simple action helps her disconnect from her emotional brain for a few seconds, which allows her to come back to her rational sense.

Practice your mental performance

If you do this for the first time, it isn't easy.

Dan couldn't "pause" during her emotional shopping moments initially. You won't get it right on the first try, and that's okay.

She started reflecting on her emotions after making a purchase and worked backward to understand her emotions. Through trial and error, she slowly implemented the technique in real-time when those moments occurred.

Perseverance is key.

Look to athletes for inspiration. Athletes aren't just masters of their physical skills; their mental game is a blueprint for success.

What sets them apart? It's their mental performance ability and their relentless refusal to give up, no matter what. It's their grit to get up every time they fall, their focus to hit the ball right instead of dwelling on every missed shot, and their belief in winning the next game even after getting bageled.

This same mindset is the secret sauce for success in managing your personal finances or any other life challenges.

The first month was tough. Dan struggled. Yet, she has relentlessly tried. She managed to stop herself whenever negativity crept in. She held onto the belief that she could improve next time.

And she did.

“The primary cause of unhappiness is never the situation but your thoughts about it.” ― Eckhart Tolle

Awareness is the agent for change to build your financial confidence.

Sophie

Don't miss out this week!

What is great about personal finances is that every month is a new opportunity. Every month, you can budget a little more, save a little more and invest a little more. That is equivalent to 12 new opportunities per year, every year. Today is a new month. If don't have a solid Payday Routine, check out my simple 6 steps here.

Don't want to wait? Sign up for my online course "Building your financial confidence in 30 days" my secret recipe to reach any financial goals, build the necessary patience and resilience for your personal finances management and beyond - See if this is the right fit for you.