What is one habit that can change drastically your finances? 1/2

Reading time: 4 minutes

Take a moment to think about what you can do every day or every week that could really shake up your personal finances for the better, BUT you are not currently doing it.

Could it be one of the following?

Keep tabs on your spending habits

Be mindful of your daily expenses

Sit down and figure out how to open a brokerage account

Adjust your investment portfolio

Dive into some financial literacy knowledge

Commit to a weekly money date with yourself (and/or your partner)

Set both long-term and short-term financial goals

Whatever it is, just write it down somewhere in your favourite notebook or digital notepad.

For years, I was caught up with - what I thought was called life priorities: i.e. making money, paying bills, socialising (and even shopping!).

As a former shopaholic, I used to love browsing fashion magazines and blogs (taht was before social media’s existence), checking out the latest trends, and hunting for the best deals. I’d spend hours comparing prices online or just looking for inspiration.

But what if I’d put even a portion of that energy into my personal finances?

What if I’d put half hour weekly to think about my financial strategy?

It took me a long time to realise that I was using all my time to make spending decisions, instead of investing decisions.

Why it’s important to pause, take a step back and strategise?

We’re so focused on our daily urgencies, it feels like there’s no room for anything else.

But have you ever wondered if all this busyness actually gets you closer to your financial/life goals?

In my job, I've had the opportunity to learn from older, wiser individuals: some who've achieved financial freedom, and some who haven't.

And the biggest difference I've noticed?

It comes down to how they prioritise their to-do list.

They prioritise what is important to them even though it’s non-urgent.

Take exercise, for example. Sure, you don’t have to work out today, you can easily push it to tomorrow, next week or even next month. But making it a regular part of your routine creates a kind of “compound interest” for your health. It builds your cardio, strengthen your muscles, boosts your discipline, and releases those feel-good hormones like dopamine and serotonin.

It’s a classic case of an important but non-urgent task (that’s Quadrant 2 - more on that later).

If health is a priority for you, you’ll make sure to fit it into your schedule (you will not find time for it).

If you don’t care about health, you can replace it with any other things you value: relationships, family, arts, hobbies, career…

The same goes for your finances. Those small, consistent actions can lead to major results over time. So, are you making time for them in your calendar too?

Using the Eisenhower Matrix for your finances

There’s a huge difference between keeping up with the day-to-day and making intentional choices that set you up for long-term financial growth.

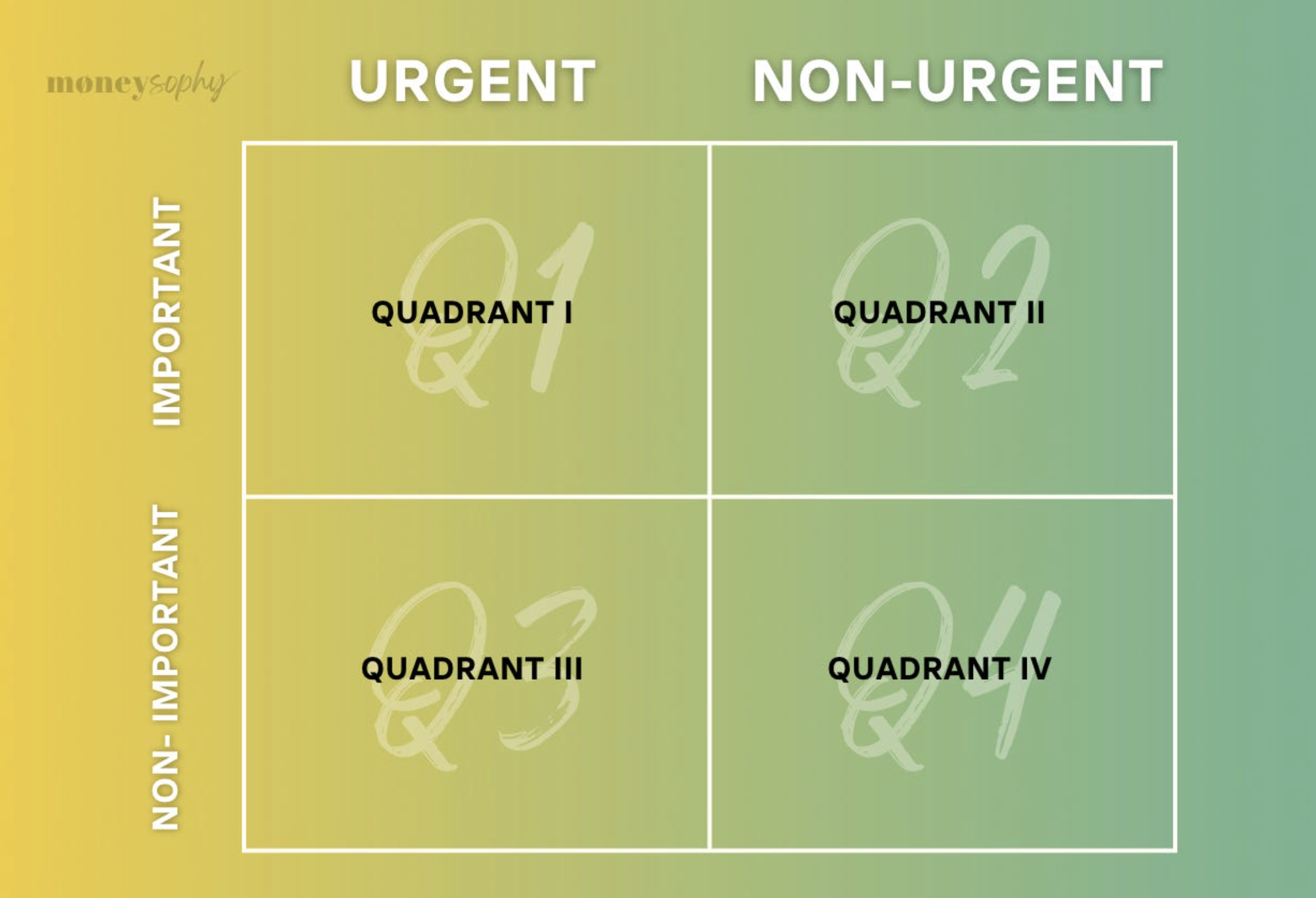

You may have heard of the Eisenhower Matrix in management, a tool for prioritising tasks based on urgency and importance as seen in the table below.

Applying it to your finances can be also a game changer. Here’s how the four quadrants work in money management:

Most of us spend too much time in Q1, Q3 and Q4, with little left for Q2 (the important, non-urgent tasks) that actually move us forward.

Building the discipline to schedule these Q2 activities is where the real work (and payoff) lies.

The Challenge?

Staying committed to those “important but not urgent” tasks requires discipline, no question (like exercising).

I hear from clients all the time “but isn’t it exhausting to plan everything?”

But think about it: you may not love brushing your teeth three times a day, but you do it to avoid that dreaded trip to the dentist, while keeping your breath fresh.

And sure, you might not enjoy exercising for an hour every other day, but you know it boosts your healthspan while enhancing your mental and physical well-being.

Checking your finances weekly might not be the most thrilling task, but you could retire the way you want, while giving you a sense of security and peace of mind.

It’s all about putting in a little effort each day for those big rewards.

And it’s easier to stay on track if you remember why you’re doing it: whether it’s financial freedom, peace of mind, or building a legacy.

Next week, I’ll dive into strategies for actually making time for more Quadrant 2 activities, well because as you know, you won’t find the time in your schedule.

So, going back to my first question: what's the one thing you can do every day that can change your finances for the better?

“If you don’t make time for your financial wellness,

you’ll be forced to make time for your financial hopelessness.”

Build your financial confidence to commit to more Quadrant 2-related activities,

Sophie