What is one habit that can change drastically your finances? 2/2

Reading time: 5 minutes

Last week, I asked you to think about one habit that could drastically improve your finances (if you missed it, it’s here)!

Odds are, you're probably not prioritising it because it feels overwhelming, easy to procrastinate, or just too busy doing other things.

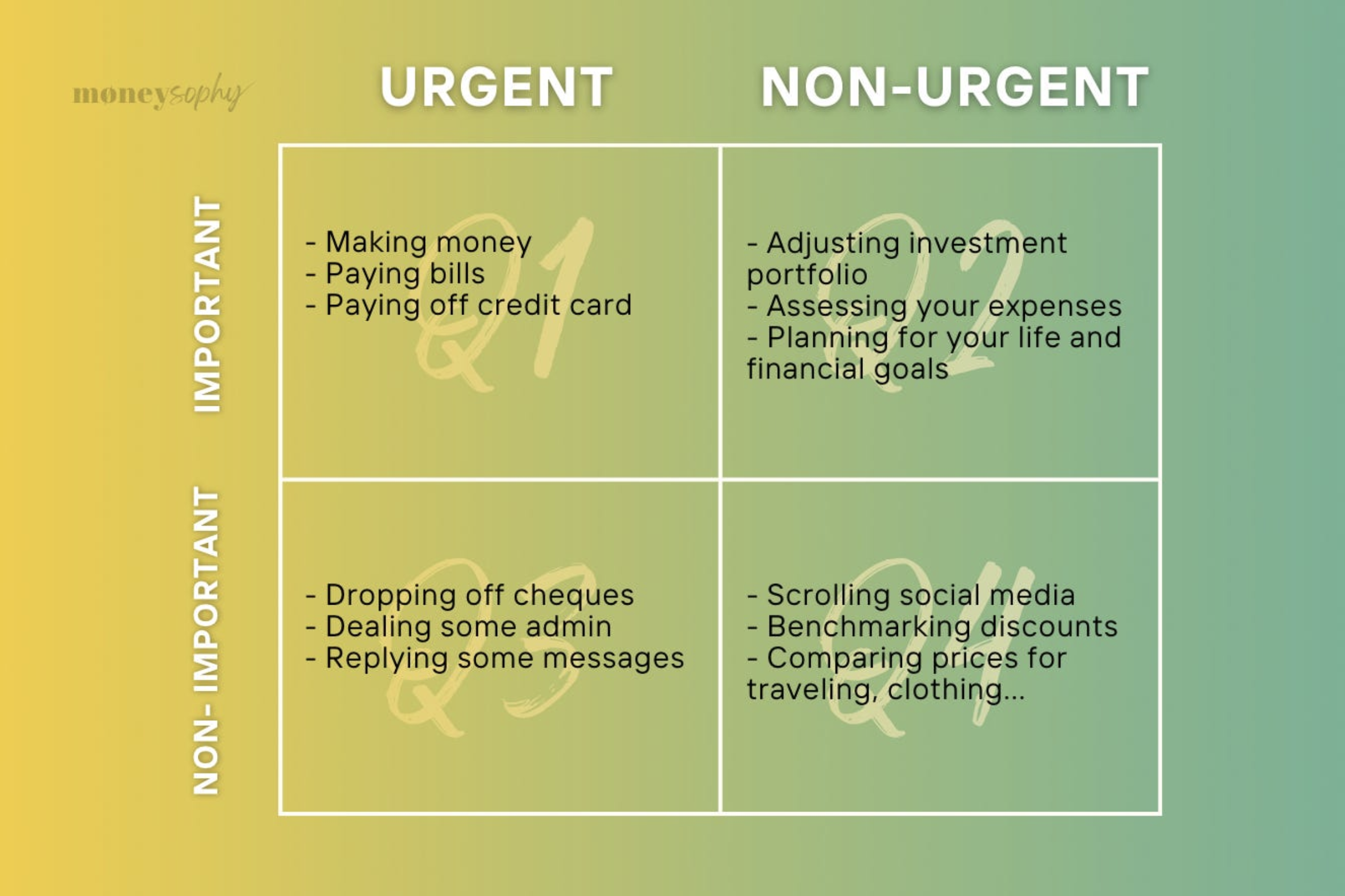

I also introduced the Eisenhower Matrix, a tool for evaluating how we spend our time. The Matrix helps categorise tasks into four quadrants:

Q1: Urgent and important (e.g., paying bills).

Q2: Not urgent but important (e.g., tracking expenses, planning investments).

Q3: Urgent but not important (e.g., eating out, buying groceries).

Q4: Neither urgent nor important (e.g., benchmarking restaurants/plane tickets, shopping)

Most of us spend way too much time in Q1, Q3, and Q4, focusing on what feels immediately pressing or just fun, leaving little space for Q2, where the proactive, long-term habits live.

Today, I’ll share ways to shift more of your time into Q2 to build stronger financial habits that will pay off in the long run.

Assess your current financial-related activities

To start, how much time to do you spend on your day-to-day financial-related activities?

Chances are that you spend way too much time on things that don’t matter, but before we just guess, what about we take a few minutes to audit our time.

Step 1: List your financial activities in each quadrant.

Here’s an example to get you started:

Q1: Paying rent/mortgage, bills, handling urgent repairs

Q2: Planning investments, creating a mindful spending plan, researching financial goals

Q3: Everyday errands, eating out, getting groceries

Q4: Nonessential scrolling, online shopping, impulsive purchases

Step 2: Estimate the time you currently spend on each quadrant.

Take a rough guess of how much time each week goes to Q1, Q2, Q3, and Q4 tasks.

Don’t worry if you find you’re spending too much time on Q3 and Q4 activities, we’re all guilty of it!

The goal is to become aware of where you are now so that you can make a plan to reallocate more time toward Q2.

Break down Q2 tasks

Now that you know where to focus, it’s time to start putting more energy into Q2 activities.

Step 1: Break these down into small, manageable steps can make it easier to get started.

Here are two examples:

1. Mindful Spending Plan: A full budget can feel intimidating, especially if it means going through months of expenses. Instead of tackling everything at once, try this:

If you want to know more, you can check out my monthly payday routine guideline here

2.Plan your Investments: If you’re new to investing, don’t dive in all at once. it can be extremely scary, instead of being paralysed and do nothing, try this:

Adapt the example to your liking!

Step 2: Set aside “non-negotiable” time for these tasks.

Schedule a time in your week to work on Q2 tasks, and remove any distractions.

Put your phone on silent, turn off Wi-Fi if possible, and make this block of time your commitment to your future.

Adopt the right mindset to build discipline

Building new habits is all about consistency. Momentum might get you started, but discipline keeps you going.

Here’s how to stay accountable:

Step 1: Do it for just for 5 minutes

Sometimes, the hardest part is simply starting. Commit to working on your Q2 tasks for five minutes. You’ll likely find that once you begin, you’ll feel like continuing.

Step 2: Tell someone

Share your goals with a friend, a family member or a partner, someone who will check in and encourage you.

Get started, motivation will follow

One of the biggest misconceptions about motivation is that we need to be motivated before we get started, also called as “the motivation myth”.

Waiting to feel motivated is just another excuse.

The truth is, motivation tends to follow action, not the other way around.

When you take that first small step (whether it’s tracking your spending or setting aside a time block for planning your finances) you start to see the impact.

You get a clearer picture of where your money goes, you feel the satisfaction of taking control, and you begin to see possibilities for your future goals.

This sense of progress and clarity is what builds motivation.

Motivation comes after you start, not before.

So instead of waiting for the “motivation”, make the choice to start small. Begin with manageable tasks, build your momentum, and soon enough, motivation will naturally follow as you see the benefits unfold.

Build your financial confidence to dedicate to do more Q2 activities,

Sophie

PS - Reply or comment this to share your Q2 financial activity and if you’ve started to implement it :)