You are not your money archetype (1/2)

It's important to dissociate you are not your money type, instead, you have a money type. Why? Money type doesn't define your identity, it's just a way that help you see the world of finances. Discover the 8 Money Archetypes and how they impact your daily financial actions.

3 lessons learned from my grandpa who worked at Macau's first casino

We all have coping mechanisms, but when they turn into addictions—whether it's gambling, investing, or shopping—they can take over our lives. Learn how to spot them early. Gambling is a serious addiction.

Starting with the end

Feeling stuck in your career or just in life? Discover how to realign your life and finances by starting with the end in mind + legacy exercise and using the ABC workbook. Find your true path today

Haunted by the past or embracing the present?

Too often, we focus on what we CAN'T control such as the weather, how people treat you: we react to things. But what if we could focus what we can control such as our own behaviour: we become proactive.

Managing money is a form of self-care

What if your best investment is yourself? The problem with investment is not the money, it's more the value you're putting behind the investment. So if you don't invest in yourself, I can already tell what is the price you're putting on yourself.

Build Financial Confidence, Change Your Life

Your money stories define your experiences and who you are today, but it doesn't define who you are tomorrow. Be a creator, not a consumer. Learn how you can change your life by building one thing: confidence.

From Theory to Practice: Get your Payday Routine on track in 4 weeks!

From the 50/30/20 budget rule to a realistic payday routine in 4 weeks:

Week 1: Get your bank system set up

Week 2: Gain financial clarity

Week 3: Be in control of your money

Week 4: Practice makes perfect!

Why I tried all diets and they didn't work for me

The problems in the health and diet industries focusing on pain and deprivation, giving the wrong solutions (arguments to be healthy) versus understanding and tackling the emotional needs of each individuals.

Our evidence fuels our confidence

Build your financial confidence series (Part 3): How can we keep it up with the new habits? Three actions to implement to never get lost in your journey. How do you personalised a plan based on your needs? We’re embracing the journey, not only the end result.

Our actions define who we are

Build your financial confidence series (Part 2): How can we take the right action towards our goal? Three concrete steps to get closer to your goal every day. How do you create an action plan that works for you? It's not a seasonal diet, it's a lifestyle choice.

Our beliefs create our reality

Build your financial confidence series (Part 1): How can we change our beliefs to improve our financial health? Three concrete steps to use your thinking brain, instead of your emotional brain, when dealing with money. Psychology plays a big part in your personal finances. Don't fight against it, learn how to play with it!

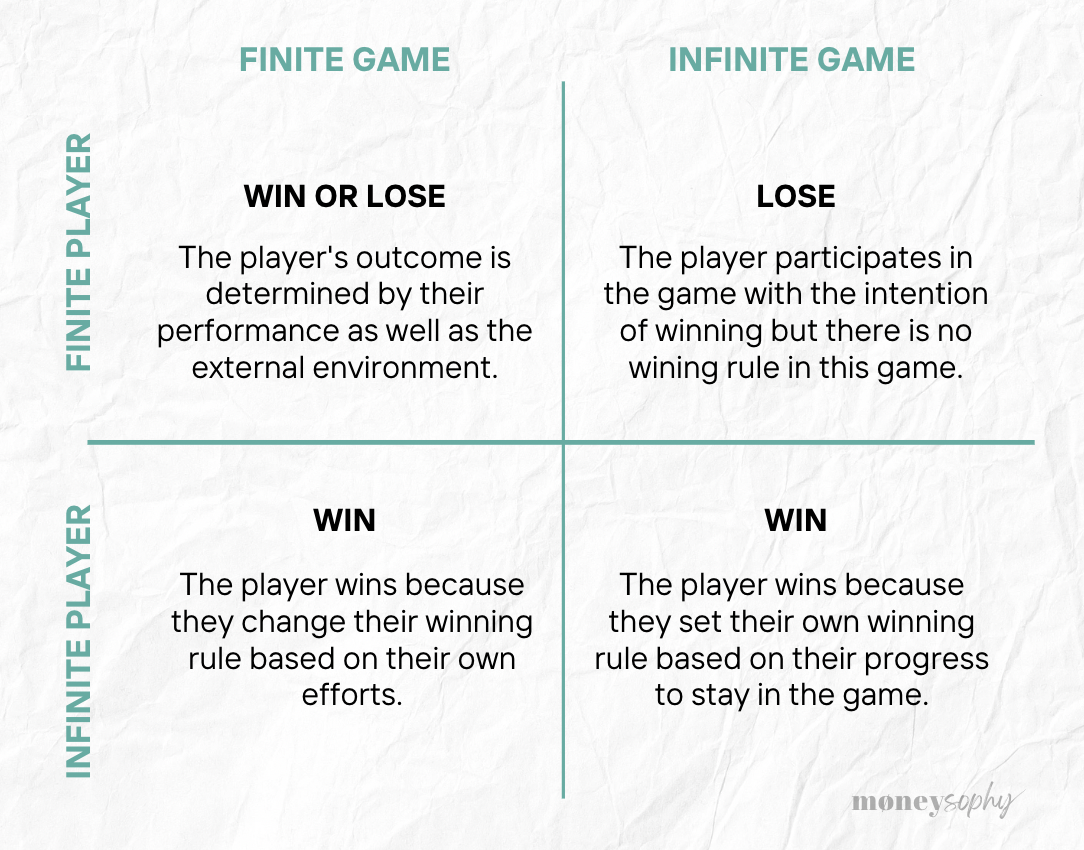

My recipe to win every single time

You can’t control everything in life, and you might lose a lot of energy, brain power and sleep in things out of your control, which is the guarantee to have a stressful life. Instead, you can live the life on your terms by becoming an infinite player and playing the infinite game. Check out my recipe for winning every single time, in everything: life, career, relationships and, of course, money.